Difficult times in the market can make it tempting to take one’s losses and cash out. It’s a natural reaction, but unfortunately, not one that has yielded great investment results over time.

EMOTIONS VS GOALS

Every investor, from the large institution to an individual, faces the same dilemma: how to balance risk and reward. Striking a positive balance between risk and reward is critical to achieving long-term investment success; however, investors face a wide variety of hurdles in achieving that balance.

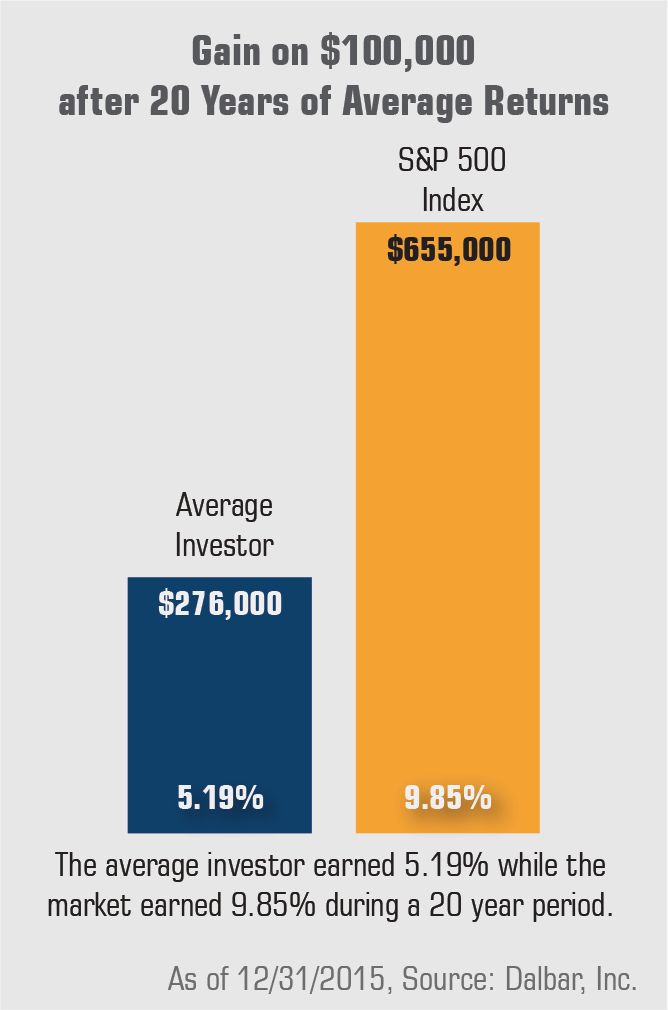

Controlling the emotions of fear and greed is the first challenge. Investment decisions that are driven by emotions may harm the investor’s long term financial goals. Historically investors have continually chased performance — investing heavily at market peaks and selling and abandoning the market after declines. As a result, investors tend to have difficulty achieving their goals. We believe most investors would benefit from having a team of experts who provide guidance, helping them stay on course while pursuing their investment objectives.

Almost all investors want positive performance with low risk. With this in mind, Clark Capital seeks to provide investment strategies that are tailored to the unique needs of an individual investor. Balancing risk and reward is a key component of our strategies.

The Investor’s Dilemma explains why many investment decisions are driven by emotions. On one hand, investors want to grow their assets to an ideal level — to have enough wealth accumulated to meet personal financial goals. Yet for the average investor, it is tempting to move out of the market when losses occur. Unfortunately, this action can be self-defeating and can lead to missed opportunities.

We believe it is critical to stay in the market over the long term to capture its gains. But without an approach that plans for good times and difficult times, emotions can wreak havoc with long term plans.

In our view, the most sensible way investors can attempt to reduce emotional risk is by employing a trusted financial advisor — one who has developed a framework for financial decision making and who provides clients with ongoing perspective and encouragement. An advisor may help a client develop and build confidence and stay committed to long term goals.