Inflation Fears Rattle Market as Stocks and Bonds Decline in February

HIGHLIGHTS:

- February saw stocks and bonds give back some of the strong gains from January after some economic data showed a rather “hot” economy.

- After hitting a 52-week low at the very beginning of February at just over 17 on an intraday basis, the VIX Index closed February at 20.70 as volatility rose.

- The 10-year U.S. Treasury yield closed January at 3.52%, but as fear grew that the Fed might stay more aggressive, it spiked to just below 4% during the month. It closed February at 3.92% and bonds struggled as rates rose.

- The FOMC raised rates at its first meeting of the year on February 1 by 0.25% as expected. The “step down” in rate hikes continues and we believe we are in the late innings of this rate hike cycle.

- Economic data continued to be mixed but a strong payroll number and higher than expected inflation readings fueled concerns that the Fed will likely need to raise rates higher and keep them there for longer than previously expected. We seem to be in a “good news is bad news” cycle as it relates to the economy and potential monetary policy action.

EQUITY MARKETS

Table 1

| Index | February 2023 | YTD |

|---|---|---|

| S&P 500 | -2.44% | 3.69% |

| DJIA | -3.94% | -1.13% |

| Russell 3000 | -2.34% | 4.39% |

| NASDAQ Comp. | -1.01% | 9.61% |

| Russell 2000 | -1.69% | 7.89% |

| MSCI ACWI ex U.S. | -3.51% | 4.32% |

| MSCI Emerging Mkts Net | -6.48% | 0.90% |

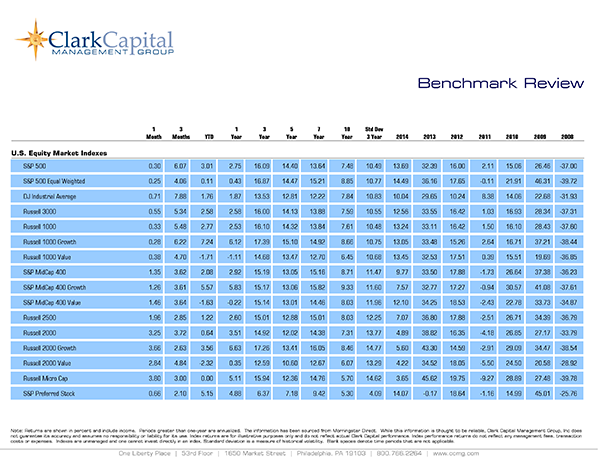

The trend from January of outperformance of small-caps and growth stocks continued in February despite declines across the board. However, January gains were enough to keep all the major indices, except for the Dow Jones Industrial Average, in positive territory year to date. As interest rates rose during February, the U.S. dollar strengthened and that created a headwind to international stocks. Emerging markets were particularly hard hit in February and were able to only hold onto modest year-to-date gains. The broader measure of international stocks, the MSCI ACWI ex U.S. Index, was also among the hardest hit areas in February, but it continued to hold onto solid gains year to date after a strong start to the year in January.

Growth outperformed value in February continuing the trend from January. For example, the Russell 1000 Growth Index declined -1.19% for the month, while the Russell 1000 Value Index fell -3.53%.

Small-caps fared better than large-caps in February as can be seen in Table 1, but growth also outperformed on a relative basis in the small-cap space. The Russell 2000 Growth Index slipped -1.08%, while its value counterpart fell -2.31%. Please see Table 1 for equity index returns for February and year to date.

The VIX Index hit a 52-week low in early February, just above 17 on an intraday basis (after the Fed raised rates by 25 basis points), but that gave way to higher volatility during most of the rest of the month as stocks weakened. The VIX Index closed February at 20.70, higher for the month and just about 1 point lower than where it ended 2022.

Fixed Income

Table 2

| Index | February 2023 | YTD |

|---|---|---|

| Bloomberg U.S. Agg | -2.59% | 0.41% |

| Bloomberg U.S. Credit | -3.01% | 0.69% |

| Bloomberg U.S. High Yld | -1.29% | 2.47% |

| Bloomberg Muni | -2.26% | 0.55% |

| Bloomberg 30-year U.S. TSY | -4.45% | 1.38% |

| Bloomberg U.S. TSY | -2.34% | 0.11% |

February was a challenging month for bonds as rates rose rather dramatically. The 10-year U.S. Treasury closed January at 3.52% but it rose to 3.92% by the end of February and this backdrop of rising rates took a toll on bond returns. The more interest-rate sensitive parts of the bond market, like U.S. Treasuries, were most impacted by rising rates compared to those pockets of bonds that are somewhat less sensitive, like high yield bonds. However, bonds were weaker across the board in February and those declines took away much of the strong gains from January, but bonds are still positive so far this year. High yield bonds stand out with their strong relative performance in February and overall positive performance year to date. Please see Table 2 for fixed income returns for February and year to date.

As we have previously stated, we believe the move higher in rates in 2022 has largely run its course at the longer end of the yield curve and we expect the 10-year yield to move lower as we go through 2023. Volatility is expected along the way and rates moved up in February, but we think the broader trend will be lower.

As has happened in previous Fed rate hike cycles, longer rates have started to come down before the Fed has stopped raising the Federal Funds rate. The market seems to now be pricing in the idea that the Fed might raise rates higher and keep them at those levels for longer than previously expected.

We maintain our long-standing position favoring credit versus pure rate exposure in this interest rate environment. We also believe that the role bonds play in a portfolio, which is to provide stable cash flows and to help offset the volatility of stocks in the long run, has not changed.

Economic Data and Outlook

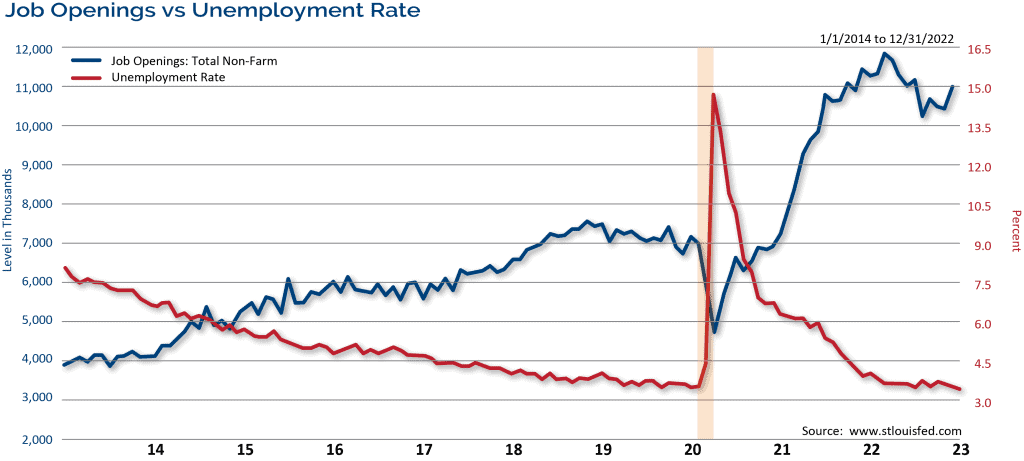

The economic momentum enjoyed by the U.S. economy in the second half of 2022 continued, as we expected, in early 2023. In January, non-farm payrolls advanced by 517,000 — easily surpassing estimates of a mere 189,000. Furthermore, the unemployment rate unexpectedly fell to 3.4% from the prior month’s mark of 3.5% and expectations of 3.6%. This was the lowest unemployment rate since 1969.

Additionally, the JOLTS reading on job openings surprised to the upside in December. Over 11 million job openings were reported in December, when only 10.3 million openings were expected. Chart 1 shows the drop in the unemployment rate coupled with a recent move higher in job openings. Technology companies have made a lot of noise lately with their layoffs, but that trend does not seem to be spreading more broadly into other areas of the economy at this point.

Chart 1.

Wages climbed by 4.4% on an annual basis, which surpassed estimates of 4.3% and the prior month’s reading was revised higher to show stronger wage growth of 4.8%. Fed action is expected to raise unemployment, but Fed rate increases so far have not resulted in significant weakness in the job market. These job market data points, while positive for the economy, are likely being viewed as inflationary by the Fed. As a result, concern developed in the market that the Fed would likely raise rates higher and keep them there longer than previously thought. In essence, good economic news is being viewed as bad news for stocks.

Housing continues to be impacted by changes in interest rates. As interest rates declined in January, there appeared to be a near-term bounce in housing activity, and particularly in new home sales. Building permits, which are considered a leading indicator for housing, were below expectations in January, but they did improve from the prior month. Housing starts missed estimates and declined from December.

Existing home sales were only modestly lower than the prior month, but they also missed expectations. However, new home sales surged to an annualized pace of 670,000 — well ahead of expectations of 620,000 and the prior month’s level of 625,000. Overall, the rise in interest rates over the last year has been a headwind to the housing market.

Fluctuations might appear in the short term, but as January saw rates decline, February saw them rise sharply again and that might have dampened housing activity during the month. Recently, we have seen some monthly drops in home prices for the first time in years, but on an annual basis values are still higher. For the month of December, home prices went down by about -0.5%, but based on the year-over year reading of the S&P CoreLogic CS 20-City Index, home prices rose by 4.65% on an annual basis. The trend has been declining home prices over the last several months. Higher mortgage rates, high home prices, and an aggressive Fed slowing general economic activity, are all headwinds to housing and home activity, which will likely slow further as the broader economy likely slows down in 2023.

The ISM Manufacturing Index showed contraction for the 3rd consecutive month in January with a reading of 47.4. (The reading for February marked a 4th straight month of contraction at 47.7) For January, New Orders Index fell to 42.5, well below the prior month’s reading of 45.1. The ISM Non-Manufacturing Index, which covers the much larger service industries in the U.S. economy, rebounded sharply from the surprise drop in activity in December.

Expectations were calling for a reading of 50.5 in January, but instead, the number climbed to 55.2. This was a welcome improvement from the December reading, which slid to a revised 49.2. Recall that ISM readings above 50 indicate expansion and below 50 signal contraction. Manufacturing had been moving rather steadily into contraction territory, but services had shown relative strength until the rather dramatic drop in December. As we mentioned last month, the December reading did appear to be “noisy” and seeing it rebound back to levels it had been for the months prior to December was welcome news.

Retail sales (ex. auto and gas) surged in January after slipping in December. Estimates were calling for a monthly gain of 0.9%, but instead sales rose by 2.6% and the prior month was revised to show less of a drop than previously estimated. It is important to note that retail sales data is not inflation adjusted, so higher prices can show stronger gains.

The preliminary University of Michigan Sentiment reading for February was better than expected and improved from January — not too surprising with stock market strength in Q4 and January. We will monitor how higher inflation data and a weaker stock market in February impacts consumer sentiment.

The Conference Board’s Leading Index continued to decline and fell by -0.3% in January as expected. The second reading of Q4 2022 GDP came in at a 2.7% annualized pace of growth, which was a slight decline from the original estimate of 2.9%. The economy weakened in the first half of 2022, but it rebounded in the second half of the year and we believe that economic momentum will continue into the first part of 2023. Early economic evidence seems to support that opinion. However, we acknowledge the risk of a mild recession has increased and we believe it is about as likely as a soft landing.

We believe that we are in the later innings of this Fed rate hike cycle and the Fed slowed the pace of rate increases once again at the February 1 meeting to a 25-basis point hike. The Fed continues to tell the market to expect rates to stay higher for longer, but following the February 1 meeting, the tone of Chairman Powell seemed less hawkish at the post-meeting news conference. However, since that February 1st FOMC meeting, inflation readings for January have come in “hotter” than expected and increased volatility in the market has followed. Concern has developed that the Fed will need to raise rates higher and for longer than previously thought.

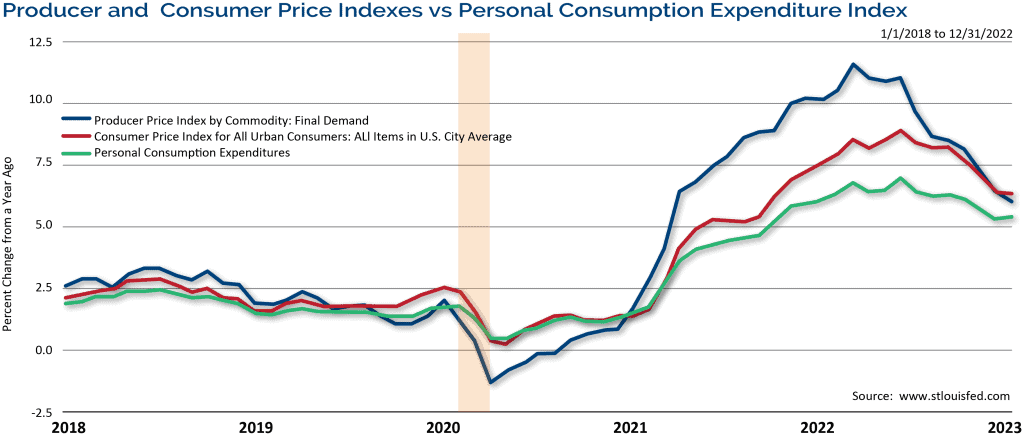

The headline Consumer Price Index dropped to 6.4% in January, but expectations were calling for a drop to 6.2%. The headline Producer Price Index fell to a 6.0% annual increase, but expectations were calling for a drop to 5.4%. The Fed’s preferred measure of inflation, the Personal Consumption Expenditures Index, actually rose to 5.4% in January from 5.3% in December.

This reading was expected to drop to 5.0%. Similarly, the core reading of the PCE Index (the primary way the Fed looks at inflation) showed a monthly increase of 0.6%, above the expected 0.4% gain and an annual increase of 4.7%, surpassing the prior month’s level of 4.6% and expectations of 4.3%. Chart 2 shows that the trend for inflation continues lower, but the pace slowed in January and there was a modest pickup in the PCE Index as well.

We believe inflation will continue to move lower as we move through 2023, but rarely do these types of readings move in a straight line and some volatility in data on a month-to-month basis should be expected. The course of Fed action in 2023 will still be of critical importance to the market and February epitomized this environment. Hotter inflation data translated into concern of a more aggressive Fed and interest rates rose and stock prices declined for the month.

The Fed’s aggressive rate hikes clearly impacted capital markets and the economy last year. Markets reset valuations based on higher interest rates and lower corporate earnings expectations in this rate-tightening cycle. However, we believe we are in the late innings of this rate hike cycle, although that time frame likely moved lengthened modestly following some recent economic data.

Although economic growth picked up in the second half of 2022 and we believe that momentum will continue early in the new year, we expect growth to slow later in 2023 and believe the odds of a mild recession are about 50/50. However, the job market has remained strong and is a critical component of our overall economy, leading us to the conclusion that any economic slowdown would be modest. As always, we believe it is imperative for investors to stay focused on their long-term goals and not let short-term swings in the market derail them from their longer-term objectives. Importantly, stocks and bonds have historically hit their lows early in the rate hike cycle, well before the Fed has made its final rate hikes and we believe those last rate hikes are still coming soon.

Chart 2.

Investment Implications

Clark Capital’s Top-Down, Quantitative Strategies

Just when equity investors optimistically pushed stock prices higher in January on the expectation of a Fed tightening regime moving to the late innings, higher reported January inflation reversed much of those stock price gains as the Fed’s tightening path moved into extras innings!

The Fed’s message was higher for longer, which weighed on asset prices. This rhetoric from the Fed coupled with all inflation metrics being higher than expectations resulted in the market repricing the Feds rate hike path and the overall interest rate market in general. The 10-year Treasury rose from 3.51% to start the month to 3.92% at the end of February. As a result, our tactical strategies, such as Fixed Income Total Return and Global Tactical, shifted to a risk-off bias favoring cash equivalents in late February.

Clark Capital’s Bottom-Up, Fundamental Strategies

The market re-evaluated the slow pace of the inflationary decline and potentially higher rates into 2024. Despite the S&P 500’s -2.6% decline, early cycle stocks continued to lead the way. Despite their lower mathematical sensitivity to raising interest rates and inflation, large-cap value and international equities were the big losers each declining more than 3.5%.

So far, the Q4 2022 earnings season has shown that the profits for corporate America are not bottoming, and the U.S. economy remains strong, although forward earnings expectations are expected to continue to decline, spelling potential short-term volatility for the market. We expect market leadership to continue to be in early cyclical sectors including Industrials, Financials, Technology and Consumer Discretionary versus defensive sectors like Consumer Staples and Healthcare.

ECONOMIC DATA

| Event | Period | Estimate | Actual | Prior | Revised |

|---|---|---|---|---|---|

| ISM Manufacturing | Jan | 48 | 47.4 | 48.4 | — |

| ISM Services Index | Jan | 50.5 | 55.2 | 49.6 | 49.2 |

| Change in Nonfarm Payrolls | Jan | 189k | 517k | 223k | 260k |

| Unemployment Rate | Jan | 3.60% | 3.40% | 3.50% | — |

| Average Hourly Earnings YoY | Jan | 4.30% | 4.40% | 4.60% | 4.80% |

| JOLTS Job Openings | Dec | 10300k | 11012k | 10458k | 10440k |

| PPI Final Demand MoM | Jan | 0.40% | 0.70% | -0.50% | -0.20% |

| PPI Final Demand YoY | Jan | 5.40% | 6.00% | 6.20% | 6.50% |

| PPI Ex Food and Energy MoM | Jan | 0.30% | 0.50% | 0.10% | 0.30% |

| PPI Ex Food and Energy YoY | Jan | 4.90% | 5.40% | 5.50% | 5.80% |

| CPI MoM | Jan | 0.50% | 0.50% | -0.10% | 0.10% |

| CPI YoY | Jan | 6.20% | 6.40% | 6.50% | — |

| CPI Ex Food and Energy MoM | Jan | 0.40% | 0.40% | 0.30% | 0.40% |

| CPI Ex Food and Energy YoY | Jan | 5.50% | 5.60% | 5.70% | — |

| Retail Sales Ex Auto and Gas | Jan | 0.90% | 2.60% | -0.70% | -0.40% |

| Industrial Production MoM | Jan | 0.50% | 0.00% | -0.70% | -1.00% |

| Building Permits | Jan | 1350k | 1339k | 1330k | 1337k |

| Housing Starts | Jan | 1356k | 1309k | 1382k | 1371k |

| New Home Sales | Jan | 620k | 670k | 616k | 625k |

| Existing Home Sales | Jan | 4.10m | 4.00m | 4.02m | 4.03m |

| Leading Index | Jan | -0.30% | -0.30% | -0.80% | — |

| Durable Goods Orders | Jan P | -4.00% | -4.50% | 5.60% | 5.10% |

| GDP Annualized QoQ | 4Q S | 2.90% | 2.70% | 2.90% | — |

| U. of Mich. Sentiment | Feb P | 65 | 66.4 | 64.9 | — |

| Personal Income | Jan | 1.00% | 0.60% | 0.20% | 0.30% |

| Personal Spending | Jan | 1.40% | 1.80% | -0.20% | -0.10% |

| S&P CoreLogic CS 20-City YoY NSA | Dec | 4.80% | 4.65% | 6.77% | 6.76% |

Source: Bloomberg

Past performance is not indicative of future results. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, other investments or to adopt any investment strategy or strategies. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Investing involves risk, including loss of principal.

Clark Capital Management Group is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Clark Capital Management Group’s advisory services can be found in its Form ADV which is available upon request.

Fixed income securities are subject to certain risks including, but not limited to: interest rate (changes in interest rates may cause a decline in market value or an investment), credit, prepayment, call (some bonds allow the issuer to call a bond for redemption before it matures), and extension (principal repayments may not occur as quickly as anticipated, causing the expected maturity of a security to increase).

Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

Foreign securities are more volatile, harder to price and less liquid than U.S. securities. They are subject to different accounting and regulatory standards and political and economic risks. These risks are enhanced in emerging market countries.

The value of investments, and the income from them, can go down as well as up and you may get back less than the amount invested.

Equity securities are subject to price fluctuation and possible loss of principal. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). Strategies that concentrate their investments in limited sectors are more vulnerable to adverse market, economic, regulatory, political, or other developments affecting those sectors.

The Bloomberg Barclays U.S. Municipal Index covers the USD-denominated long-term tax exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds and prerefunded bonds.

The Dow Jones Industrial Average indicates the value of 30 large, publicly owned companies based in the United States.

The NASDAQ Composite is a stock market index of the common stocks and similar securities listed on the NASDAQ stock market.

The S&P 500 measures the performance of the 500 leading companies in leading industries of the U.S. economy, capturing 75% of U.S. equities.

The University of Michigan Consumer Sentiment Index rates the relative level of current and future economic conditions. There are two versions of this data released two weeks apart, preliminary and revised. The preliminary data tends to have a greater impact. The reading is compiled from a survey of around 500 consumers.

The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values.

Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index.

The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values.

The Russell 2000 Index is a small-cap stock market index that represents the bottom 2,000 stocks in the Russell 3000.

The Russell 2000 Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower expected and historical growth values.

The Russell 2000 Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe.

The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

The 10 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 10 year. The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the “risk free” rate when valuing the markets or an individual security.

The 30 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 30 years. The 30 year treasury yield is included on the longer end of the yield curve and is important when looking at the overall US economy.

Bloomberg Barclays U.S. Aggregate Bond Index: The index is unmanaged and measures the performance of the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including Treasuries and government-related and corporate securities that have a remaining maturity of at least one year.

The Bloomberg Barclays U.S. Corporate High-Yield Index covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

The Bloomberg Barclays U.S. Credit Index measures the investment grade, U.S. dollar denominated, fixed-rate taxable corporate and government related bond markets.

The ISM Non-Manufacturing Index is an index based on surveys of more than 400 non-manufacturing firms’ purchasing and supply executives, within 60 sectors across the nation, by the Institute of Supply Management (ISM). The ISM Non-Manufacturing Index tracks economic data, like the ISM Non-Manufacturing Business Activity Index. A composite diffusion index is created based on the data from these surveys, that monitors economic conditions of the nation.

ISM Manufacturing Index measures manufacturing activity based on a monthly survey, conducted by Institute for Supply Management (ISM), of purchasing managers at more than 300 manufacturing firms.

The MSCI Emerging Markets Index captures large and mid cap representation across 27 Emerging Markets (EM) countries.

The MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 Developed Markets (DM) countries (excluding the US) and 27 Emerging Markets (EM) countries*. With 2,359 constituents, the index covers approximately 85% of the global equity opportunity set outside the US.

The S&P CoreLogic Case-Shiller 20-City Composite Home Price NSA Index seeks to measures the value of residential real estate in 20 major U.S. metropolitan areas

The U.S. Treasury index is based on the recent auctions of U.S. Treasury bills. Occasionally it is based on the U.S. Treasury’s daily yield curve.

The CBOE Volatility Index, known by its ticker symbol VIX, is a popular measure of the stock market’s expectation of volatility implied by S&P 500 index options.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

The Producer Price Index (PPI) program measures the average change over time in the selling prices received by domestic producers for their output. The prices included in the PPI are from the first commercial transaction for many products and some services.

CBOE Global Indices is a leader in the creation and dissemination of volatility and derivatives-based indices.

The Conference Board’s Leading Indexes are the key elements in an analytic system designed to signal peaks and troughs in the business cycle. The leading, coincident, and lagging economic indexes are essentially composite averages of several individual leading, coincident, or lagging indicators. They are constructed to summarize and reveal common turning point patterns in economic data in a clearer and more convincing manner than any individual component – primarily because they smooth out some of the volatility of individual components.

Index returns include the reinvestment of income and dividends. The returns for these unmanaged indexes do not include any transaction costs, management fees or other costs. It is not possible to make an investment directly in any index.

CCM-993