Back to the Future… Trump 2.0

Highlights

We believe:

- 2025 will be underpinned by strong fundamentals and a market with many tailwinds with the potential to grow by 2.5%.

- Bullish trends include the first year of a President’s term, consecutive 20% or greater returns, and earnings momentum. Our year-end target for the S&P 500 is 6700, and we expect increased volatility in 2025.

- Rate cuts will slow down in 2025, and we believe there will be two for the year, one more than is currently priced in.

- The 10-year Treasury Note yield should remain rangebound between 3.5% and 5.0%, with a path dependent on inflation and policy initiatives.

- Some risks to the outlook include: echo inflation, policy uncertainty, tariffs, the valuation landscape, geopolitics (Russia/Ukraine, Middle East, China/Taiwan), and the U.S. government’s fiscal position.

Year in Review

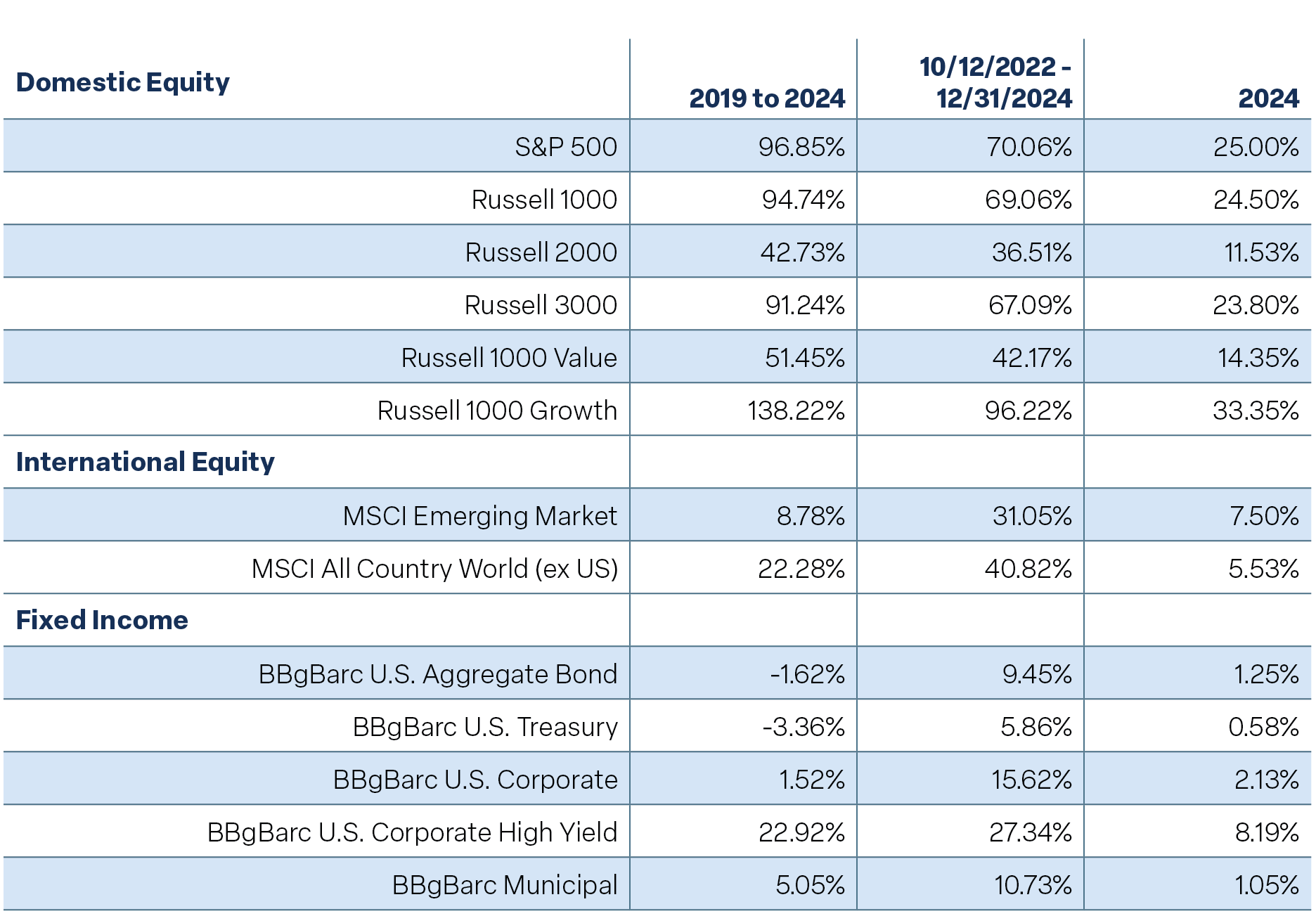

2024 was a banner year for risk assets, but the rising tide did not lift all boats equally. The S&P 500 Index logged its first record high on January 19 and ended a stellar year with 57 new all-time highs, the sixth most record high days since 1928. Additionally, the S&P 500 recorded consecutive year gains of 20%, the first time since 1999. Relatively speaking, there were clear winners and losers. Stocks posted their fifth-best year versus bonds, large-caps logged their fourth-best versus small-caps, and growth’s year was its fifth-best versus value since the late 1970s. U.S. stocks outperformed international stocks for the thirteenth time in 15 years. Surprisingly, only 29% of S&P 500 stocks outperformed the index, a near-record low.

The indices posted solid gains in 2024. The S&P 500 gained 25.0%, the Russell 2000 Index gained 11.53%, and the Russell 1000 Growth and Value Indices gained 33.35% and 14.35%, respectively. It was only the tenth time in the post-WWII era that the S&P 500 posted consecutive 20% plus total return years. International stocks lagged, with the MSCI ACWI ex-U.S. Index up only 5.53%. Fixed income returns were mixed, with credit outperforming duration. The Bloomberg U.S. High Yield Index was the clear winner, gaining 8.19%, the Treasury Index gained 0.58%, and the Aggregate Bond Index advanced 1.25%.

Longer-term, the equity markets have had a terrific run over the past five years, considering we experienced a global pandemic, recession, and two bear markets. For some perspective on equity and fixed income returns over the past five years, see Figure 1 below.

Figure 1

Perspective

Past performance is not indicative of future results. This is not a recommendation to buy or sell a particular security. Please see disclosures at the end of this document.

Executive Summary

Last year’s outlook noted, “Solid labor market conditions, economic momentum, a more dovish Fed, and decelerating inflation counter the recession concerns.” We expected the economy to grow by 2.25%, and it ended the year with approximately 2.5% growth.

We also noted that the Fed would likely begin cutting rates in what we called a “recalibration of Fed policy.” At the time, the market was pricing in six-and-one-half cuts. We said, “That is likely too aggressive; we see four cuts.” By year-end, our expectations were met with 100 basis points of rate cuts. Finally, we expected a good year for the markets and initially had a 5300 target on the S&P 500. Our original target was surpassed in the second quarter, prompting us to increase our target to 5800. By the end of the year, the S&P 500 closed at 5881.

We believe that 2025 will see a continuation of the cyclical bull market, but not another straight line higher. The economy has been remarkably resilient, and our base case assumption is for continued economic growth. We also believe that inflation is on a gradual, not linear, path lower, and the labor market’s strength will help to avoid a recession. We think there’s the potential for economic growth of 2.50% in 2025 as the Fed easing and pro-growth Trump policies, deregulation, productivity, and animal spirits keep the economy growing.

Bullish trends include the first year of a President’s term, consecutive 20% or greater returns, and earnings momentum. Continued economic growth and new highs in corporate earnings suggest another year of gains for the market. Our year-end target for the S&P 500 is 6700. Gains could be front-loaded based on the Presidential Cycle trends and we believe volatility will increase this year.

While valuations are lofty, they are not a good timing tool. Looking ahead, we expect a decreased pace of price appreciation and earnings to again be the primary driver for stock prices in 2025.

There are many risks to the outlook includingbecho inflation, policy uncertainty, tariffs, the valuation landscape, geopolitics (Russia/Ukraine, Middle East, China/Taiwan), and the U.S. government’s fiscal position.

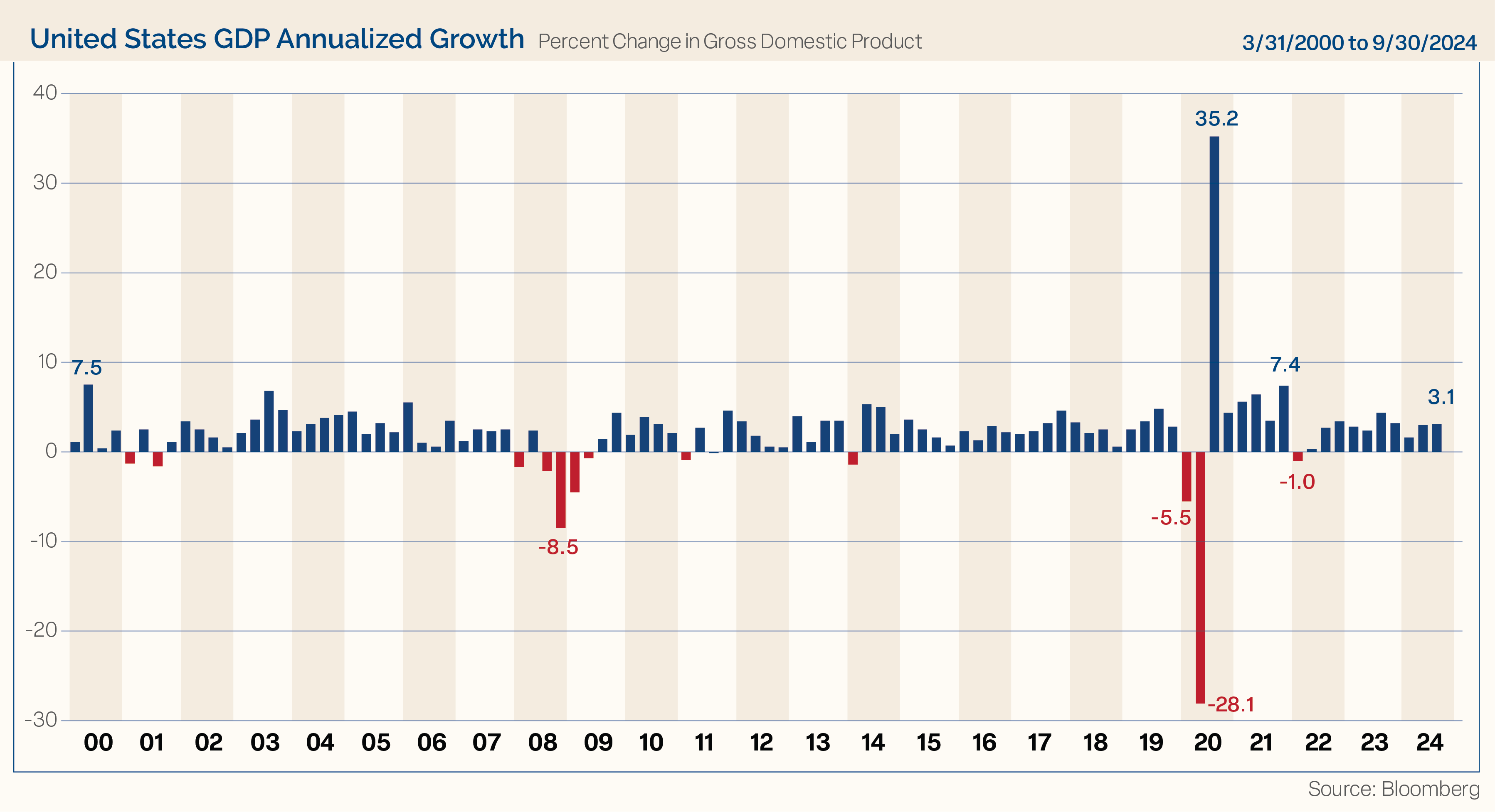

GDP and Economic Expansion

In 2025, we see an economy underpinned by strong fundamentals and a market with many tailwinds. The economy remained resilient as inflation slowed and the Federal Reserve began a rate-cutting cycle. As shown in Figure 2, the economy grew in 10 consecutive quarters through the third quarter of 2024. The Atlanta Fed’s GDPNow forecast model shows that the economy expanded at a 2.7% annualized pace in the fourth quarter, making it the eleventh consecutive quarter of growth. We believe that this momentum will continue and think the economy has the potential to increase by 2.50% in 2025.

Figure 2

Animal spirits, deregulation, and pro-growth policies look to support economic expansion. The Manufacturing and Service sectors posted better-than-anticipated results through year-end. The Manufacturing sector has contracted for most of the past two years, but it looks to be turning higher while the Service sector remains steady in expansion territory. Cooling inflation statistics and steady economic growth produce a “Goldilocks” feel; the porridge is neither too hot nor too cold but just right.

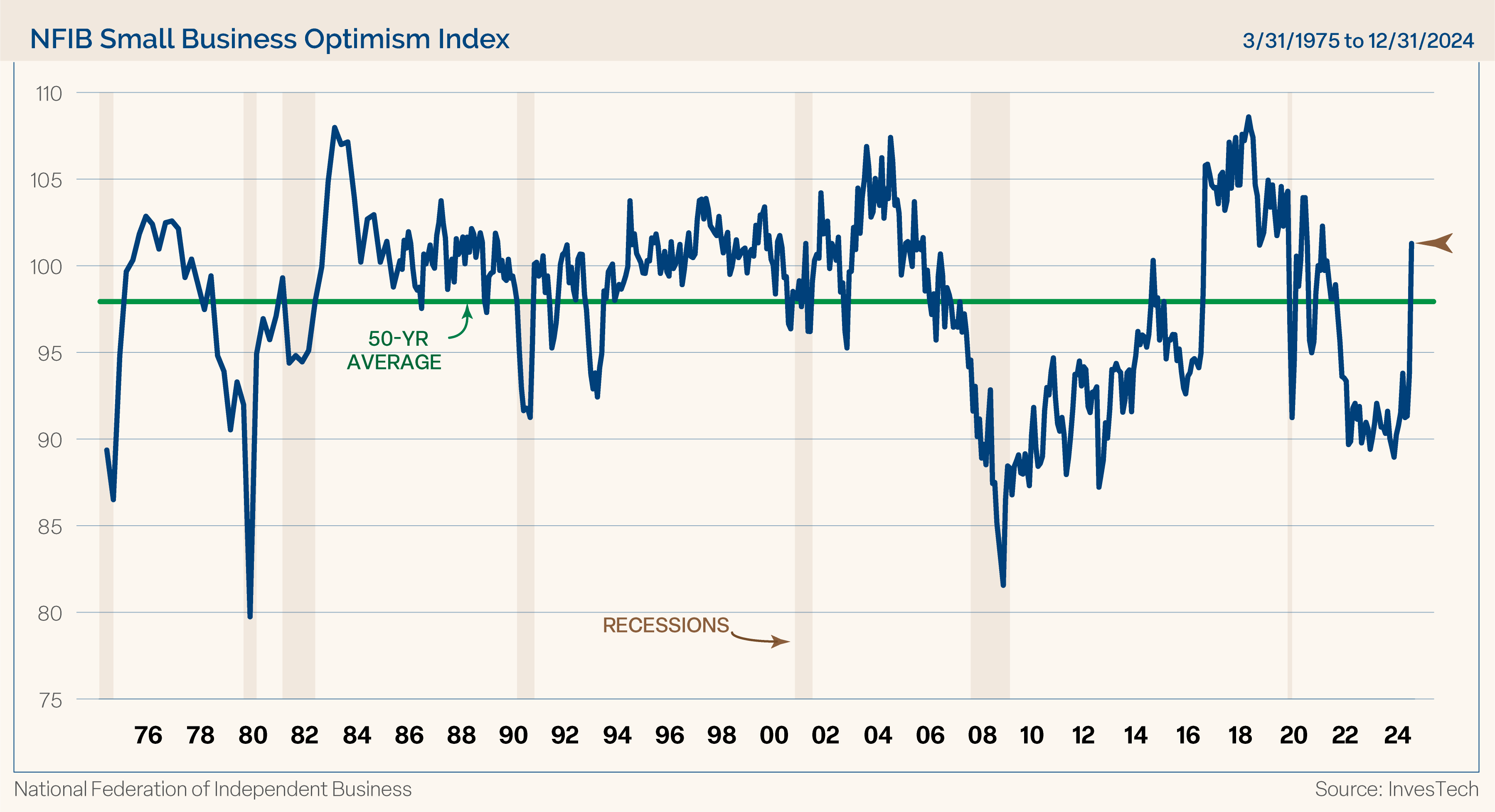

Small Business Optimism

Some leading macroeconomic indicators show signs of newfound strength after a period of weakness. For example, sentiment among small business owners dramatically improved in November because of post-election euphoria and anticipation of pro-business policies. Animal spirits, a term coined by John Maynard Keynes, refers to how human emotion can drive financial decision-making in uncertain environments and volatile times.

As shown in Figure 3, the National Federation of Independent Business (NFIB) Optimism Index surged nearly eight points and, for the first time in almost three years, surpassed its 50-year average. This upturn in the business owners’ attitudes has historically been a reliable sign of continued economic growth.

Figure 3

In our last two Annual Outlook publications, we stated, “Until meaningful weakness is revealed in the labor market, calls for recession seem premature.” While we still don’t see signs of a recession, the labor markets are sending warning signals.

A record number of people are employed; however, the level shows no growth and is flat year-over-year. While the unemployment rate is not a leading indicator for the economy, it does signal a slowing economy. At 4.2%, the unemployment rate is still historically low but has climbed 0.8 points from its April 2023 low. This rise coincides with other evidence that labor market conditions have cooled, job openings have declined, and quit rates are at cycle lows. Overall, the labor market appears steady, but close monitoring is warranted.

However, our favorable economic outlook is not without risks. Looking back, nine of the last 15 recessions occurred in the first year of a president’s term, possibly due to several factors, including economic cycles and policy shifts. Additionally, newly elected presidents often prioritize implementing policy changes early in their terms, hoping to address financial challenges and pave the way for recovery. In the case of President Trump, potential economic headwinds include tariffs, mass deportations, and the impact on government spending from the Department of Government Efficiency (DOGE).

While we expect continued economic growth throughout the year, we are aware of potential challenges.

S&P 500 Bull Market Duration

A look at the equity markets

The current cyclical bull market is slightly more than two years old. While the average bull market lasts about four years, durations can vary significantly. Furthermore, bull markets don’t just die of old age. The direction of this cyclical bull market depends on whether inflation moderates or reverses, whether earnings growth accelerates or decelerates, or if an unexpected shock disrupts the rally.

Figure 4 shows the Ned Davis Research Cycle Composite for 2024. It combines the one-year cycle, four-year cycle (election years), and decennial cycle into a single composite.

Figure 4

In our 2024 Outlook, we stated, “The Composite suggests a choppy/sideways market into the summer, which would buy the market time to consolidate its large gains from 2023, then a strong rally in the second half of the year. That playbook is very consistent with the normal Presidential Election Year trends.” While that script mostly played out, the market was stronger than the composite suggested early in the year, modestly corrected in the summer, and finished the second half of 2024 strong.

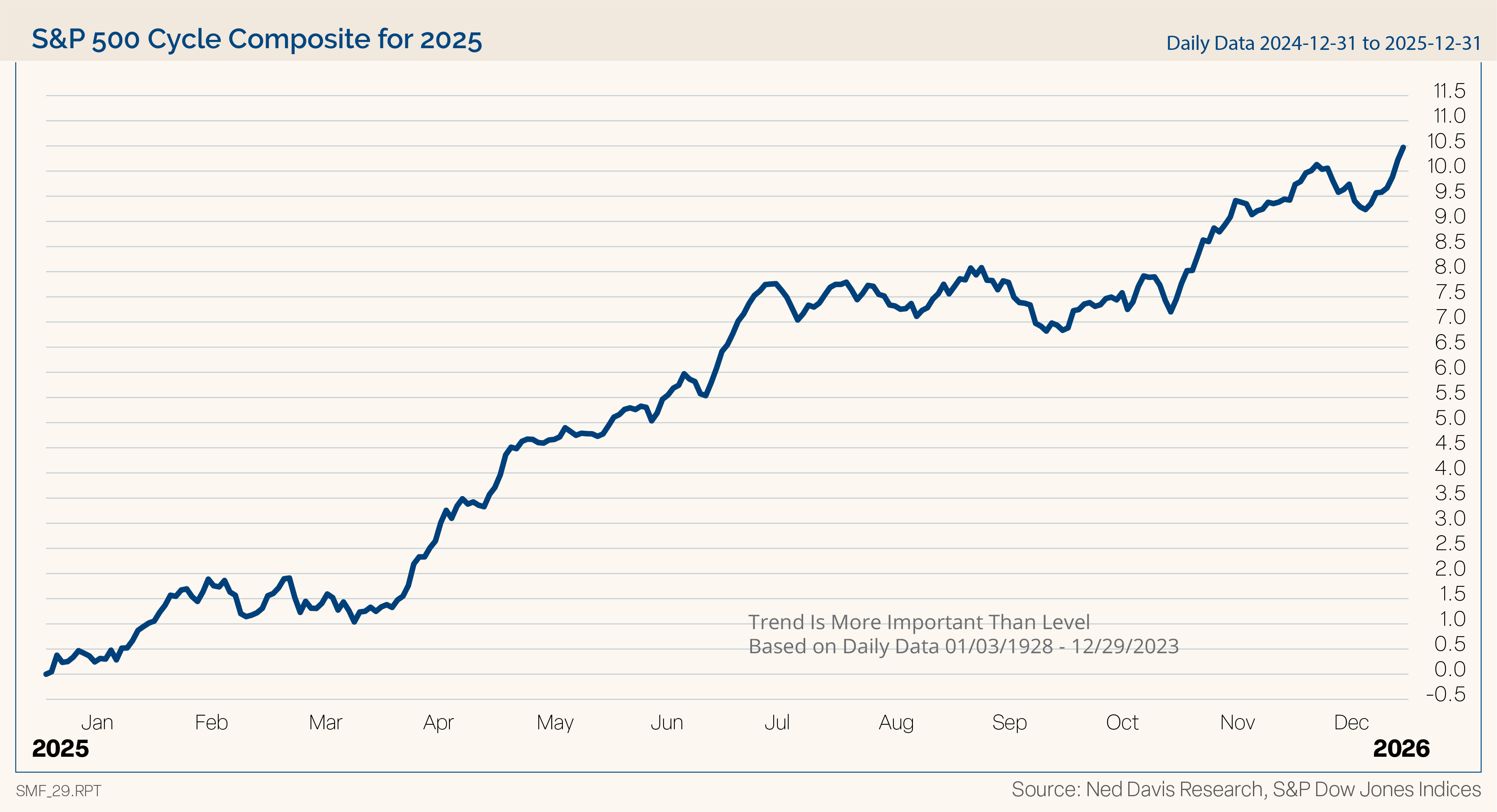

Cycle Composite for 2025

The NDR S&P 500 Cycle Composite for 2025, shown in Figure 5 paints a bullish picture throughout the year and diverges from the second-half weakness implied by the presidential cycle.

Figure 5

The Cycle Composite shows a strong first-half, third-quarter pullback, and year-end rally. Inflation trends and EPS growth will likely determine the direction for the second half of the year, either following a bullish Cycle Composite or a cautious four-year cycle. Additionally, Trump’s anticipated fiscal policies could impact economic growth, influence monetary policy, and be at the top of investors’ minds, thus affecting market behavior.

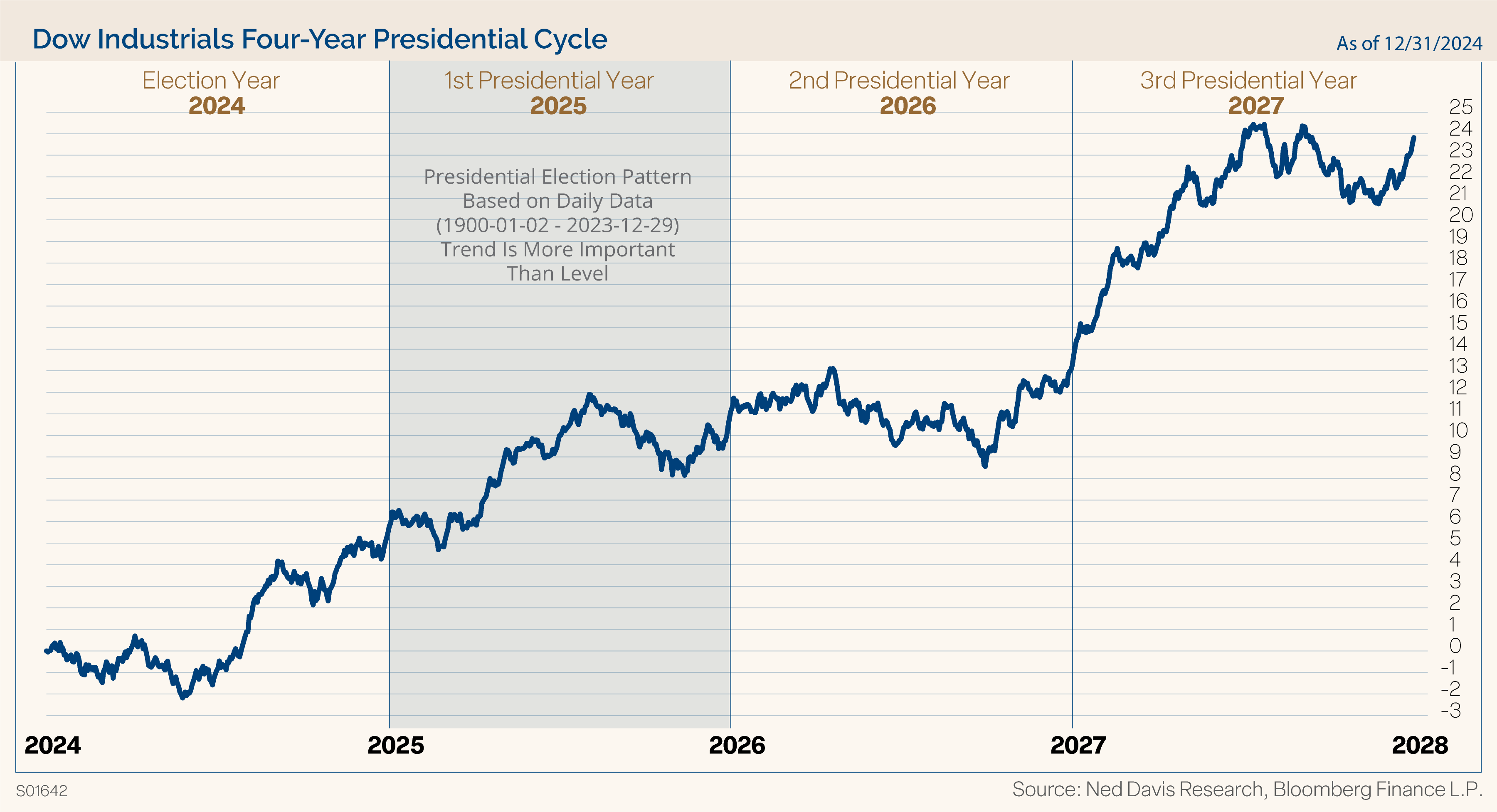

Four-Year Presidential Cycle

Figure 6 shows historically, markets perform positively during the first year of a new administration. The post-WWII median gain for the S&P 500 in the first year of a president’s term is 9.1% (simple price appreciation).

Figure 6

Typically, strength is experienced early on, followed by a broad consolidation period lasting from mid-year through the mid-term election year low. One reason for this is restrictive monetary and fiscal policies lasting from late in the post-election year until the mid-term elections.

In addition to the Fed policy, further tax cuts beyond those already extended from 2017 may prove difficult with a narrow Republican advantage in Congress, while potential tariffs and deportations are viewed as restrictive fiscal policy.

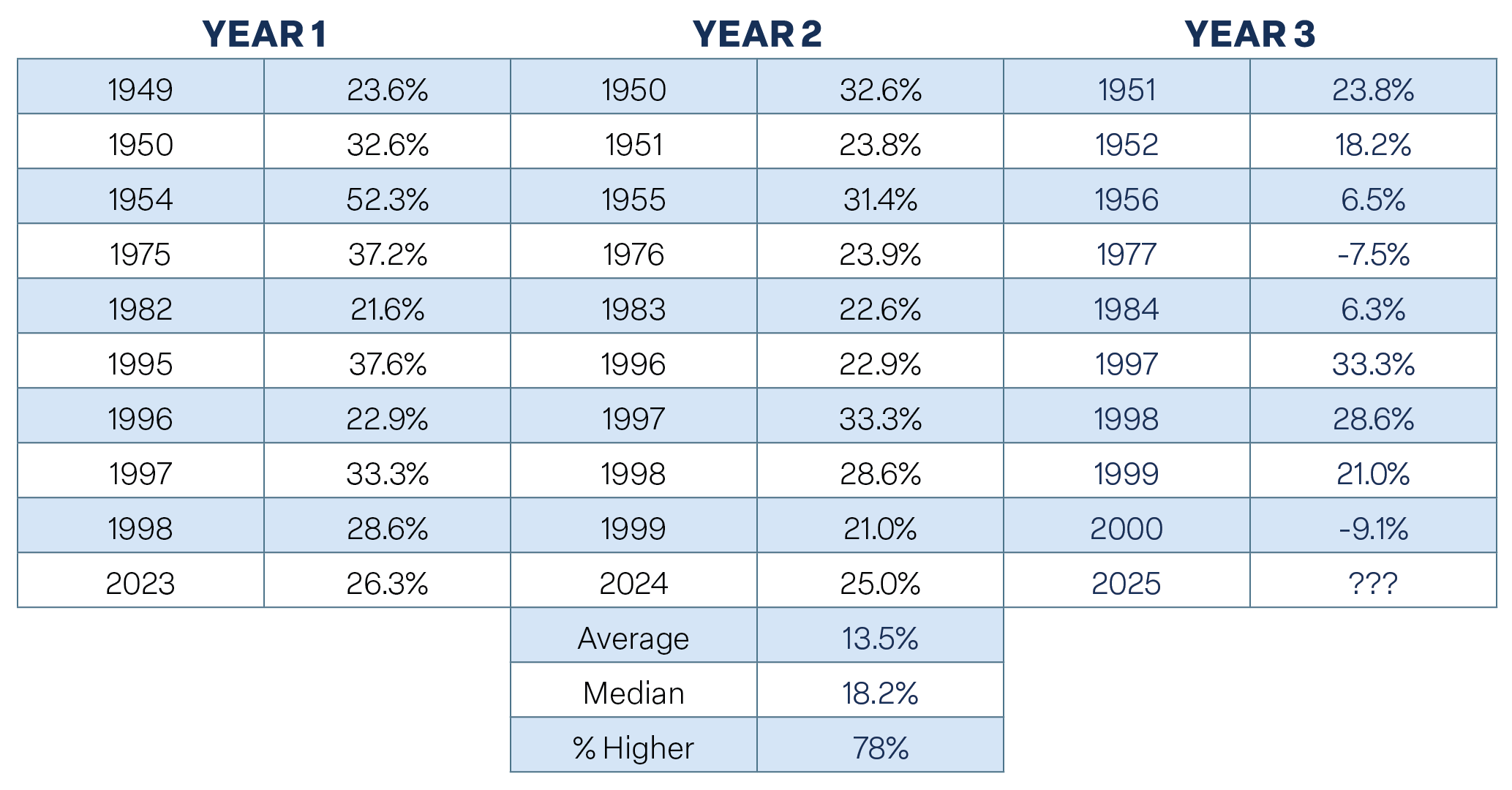

Back-to-Back 20% Gains

The S&P 500 recently posted consecutive 20% plus gains on a total return basis, the tenth time since post-WWII. Given substantial gains in 2023 and 2024, there is reason to believe that the market may struggle to continue those gains in 2025. However, history paints a different picture. As shown in Figure 7, in the nine prior cases of consecutive 20% gains, the market gained an average of 13.5% in the third year and was up in seven cases (78%). In the third year, the market was lower only twice: in 1977 and 2000, both during secular bear markets.

Figure 7

Back-to-Back 20% Gains

For illustrative purposes only. Past performance is not indicative of future results.

Markets are Cyclical, and Corrections are Normal

Since 1928, data indicates that, on average, the S&P 500 has experienced three 5% corrections per year, a 10% decline once a year, a 15% decline every two years, and a 20% or more significant bear market every three years.

The major indices have behaved linearly since the bear market lows in October 2022. Last year, there were two corrections greater than 5% but none 10% or greater. After 57 new record highs in 2024 and no real correction, we believe the markets have the potential to become more cyclical with normal corrections in 2025.

Money Market Fund Assets

The mountain of cash sitting in money market funds continues to grow. ICI data shows that total assets in money market funds reached a record $6.8 trillion, up from $4.73 trillion at the end of 2022, and this growth continues to accelerate rapidly.

As we stated last year, “That is a lot of dry powder to potentially come off the sidelines. We certainly don’t expect it all to flow into the market, but around the margin, there is a lot of cash to deploy. The large amount of cash on the sidelines could help keep corrections in check.” This statement holds today as liquidity is abundant, a positive factor for the markets.

A Look at Valuations: the Market is Not Cheap

The S&P 500’s P/E ratio ranks in the 96th percentile compared to all periods since 1929, and the forward multiple of 22.3 ranks in the 90th percentile. While these rankings are impressive, valuations serve as a terrible timing tool. Heading into 2024, the S&P 500’s trailing P/E was already in the 90th percentile, while the forward P/E was in the 85th percentile. Despite that, the S&P 500 rallied more than 20%.

While the market may be expensive, it’s primarily a large-cap phenomenon, driven by mega-cap technology companies. The MegaCap-8’s forward P/E ratio is 29.5, while the S&P 400 Mid Cap and S&P 600 Small Cap Indices trade with a 15X forward P/E, a significant discount to the S&P 500. Based on valuations, there is opportunity in other market areas beyond the mega-cap technology stocks.

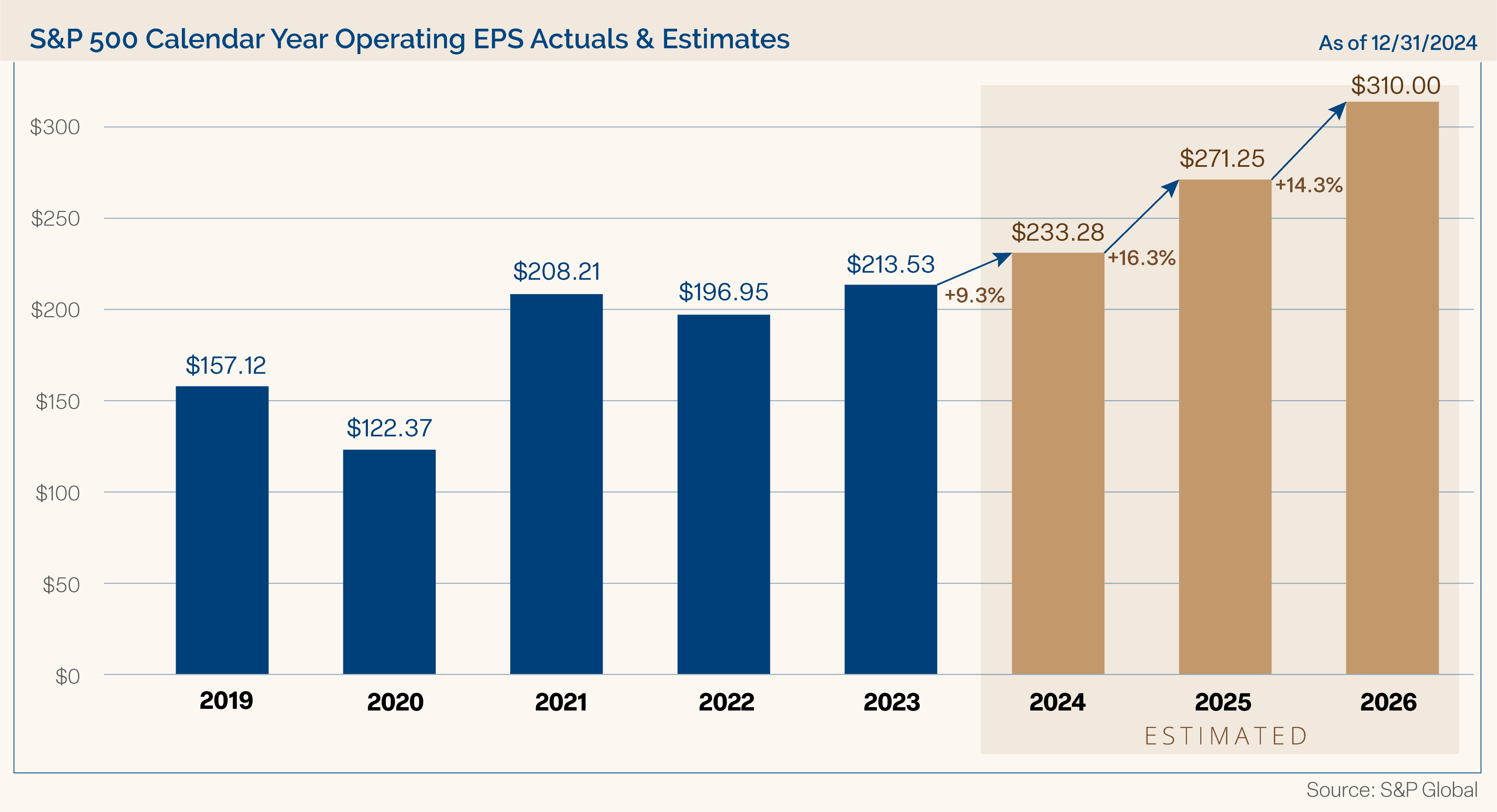

Calendar Year Operating EPS

Although many investors are concerned about high stock valuations, we believe that our bullish outlook for strong productivity-led economic growth means that earnings have the potential to lead the market higher.

As shown in Figure 8, S&P 500 companies’ actual earnings are in blue, and analysts’ expected earnings for the calendar years 2024, 2025, and 2026 are shown in orange. Actual earnings and estimates continue to rise sharply, with trailing and forward earnings hitting new highs.

Figure 8

Beginning 2024, the bottom-up earnings estimate for the calendar year 2026 calls for $310 per share for the S&P 500. Applying a forward P/E multiple of 21.5, a slight compression from its current level implies a 6665 target at year-end. Factoring earnings growth, a slight forward P/E compression, bullish historical trends from the first year of a president’s term, and following consecutive 20% total return years, our 2025 year-end target for the S&P 500 is 6700. That represents a 13.9% gain from where it closed in 2024.

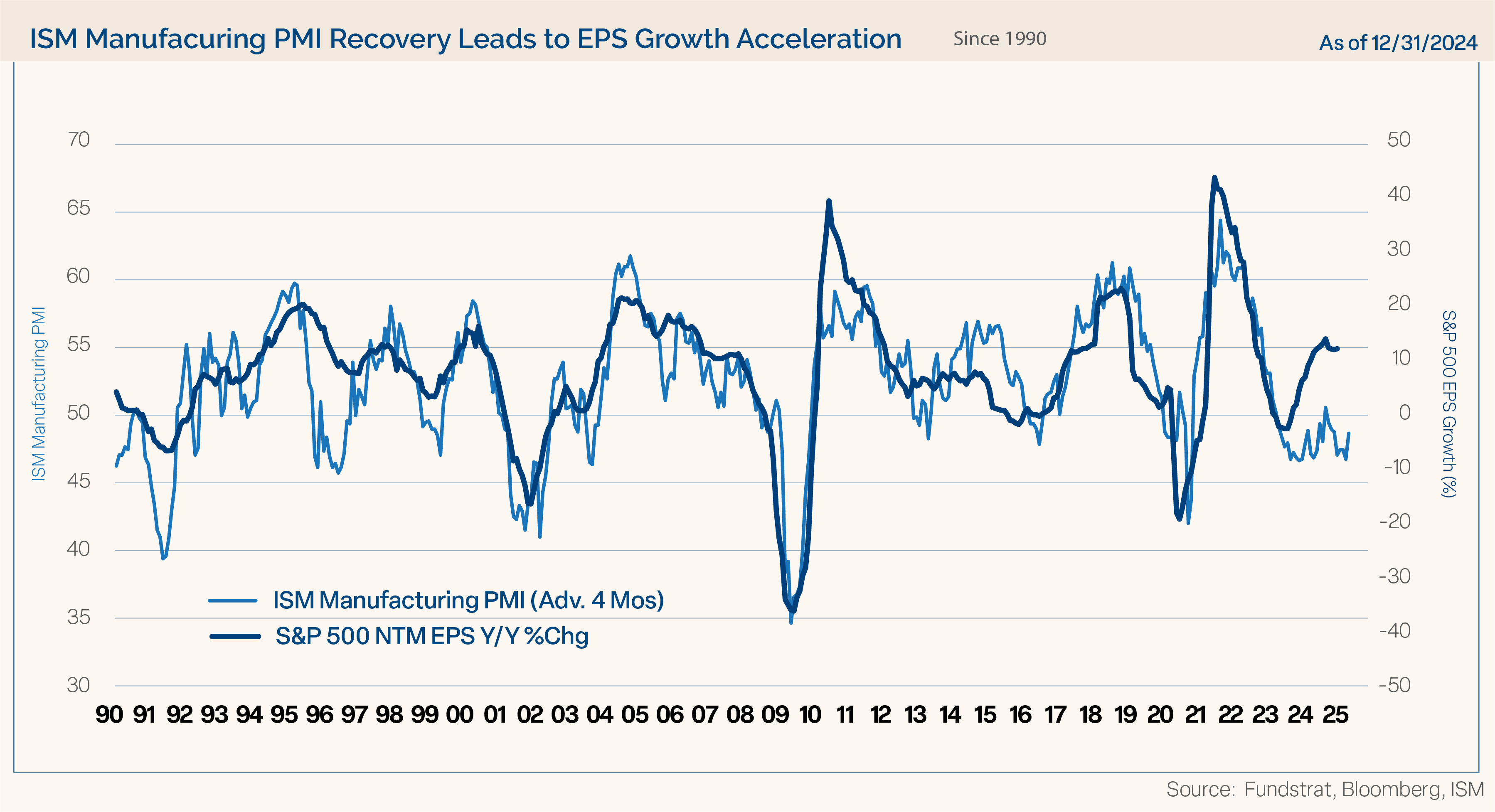

ISM Manufacturing & Earnings Growth

After two years of contraction in the Manufacturing sector, we are optimistic about continued earnings growth as it appears poised to cross into expansion territory. The ISM Manufacturing Index improved sharply over the past two months, and as shown in Figure 9, there is a high correlation between the Manufacturing sector and S&P 500 earnings growth. If the Manufacturing sector continues to rebound, it should support additional earnings growth.

Figure 9

Recently, earnings growth was concentrated mainly in large-cap technology and secular growth stocks, with less than 50% of the S&P 500 Index names increasing earnings by more than 10%. With ongoing economic growth, the administration’s potential deregulation and pro-business policies, and the Manufacturing and Service sectors likely in expansion territory, we anticipate a broadening

of earnings trends.

Small Caps: Undervalued Relative to S&P 500

The case for the market to broaden is strong, especially for small-caps. The expected 2026 earnings growth for small-cap stocks is greater than that of the S&P 500, with median earnings growth anticipated at 18.4% and 9.8%, respectively. Additionally, small-cap expected earnings growth is higher at every quartile.

Small-cap valuations are more attractive with a median forward P/E based on 2026 expected earnings of 13.6 versus 17.2 for the S&P 500. Small-caps are comparatively cheaper across all valuation quintiles except the highest, which includes companies without earnings.

Small-caps have endured one of the worst periods of underperformance relative to large-caps. The S&P 500 outperformed the Russell 2000 by 130 percentage points over the past 10 years, setting up a potential mean reversion in performance, which the valuation and earnings landscape supports.

Inflation and Fed Policy

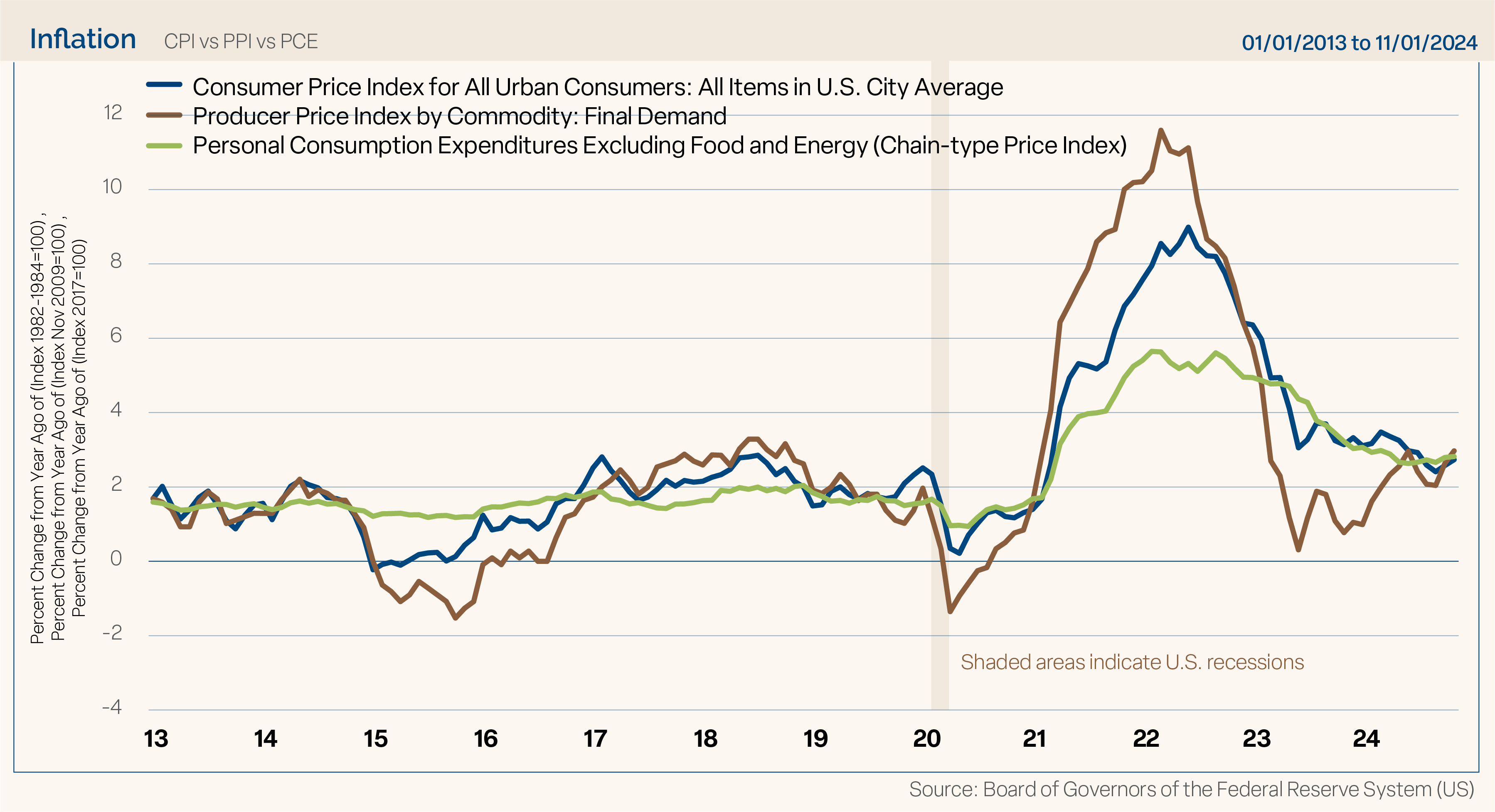

As shown in Figure 10, inflation has retreated from peak levels, with CPI, PPI, and Core PCE (the Fed’s preferred inflation measure) stabilizing within a 2.7% to 3.0% range. However, progress in reducing inflation further remains slow. In the long term, while the Fed’s inflation target is 2.0%, CPI has averaged 2.6% for the past 20 years.

Figure 10

Contrary to what some may fear, we do not believe inflation is set to reaccelerate higher as four of the key drivers of the inflation surge the past couple years continue to moderate. For example, housing, auto insurance, and used car prices are softening, and labor markets are not exhibiting inflationary impulses.

Housing costs remain the primary driver of inflation, keeping headline inflation above the Fed’s target. Actual rental costs lead the housing component of CPI in both directions. Over the past year, actual apartment rental inflation was negative, a lagged impact on CPI that we are now beginning to see. We believe that normalizing housing rental inflation will ensure a return to the Fed’s target, as this has been the most significant shortfall.

As mentioned and highlighted in Chairman Powell’s comments after the December FOMC meeting, the labor market has not been a significant source of elevated inflation. With productivity running steadily, high nominal wage growth is not inflationary.

Nominal wage growth remains high despite a hiring slowdown and an increased unemployment rate. However, the rise in wages has been offset by a spike in productivity: actual output per worker was up 2.0% year-over-year in the third quarter. If the spread between nominal wage growth and productivity growth is modest, we believe that inflation should be contained.

After 100 basis points of rate cuts, future reductions are set to slow down as 2025 begins while the Fed analyzes the impact of those in place and awaits tariff and policy initiatives set forth by the new administration. By signaling this slowdown, the Fed is hedging against potential risks posed by Trump’s anticipated policies.

After stronger-than-expected economic data and higher inflation uncertainty driven by election results in November, the market is only pricing in one rate cut for 2025, a much different outlook than last year. Given that rates have normalized and have been reduced by 100 basis points, we don’t anticipate the Fed will deliver many cuts this year. We believe there is the potential for two rate cuts in 2025, not drastically different from market expectations.

Historical Market Performance After Rate Cuts

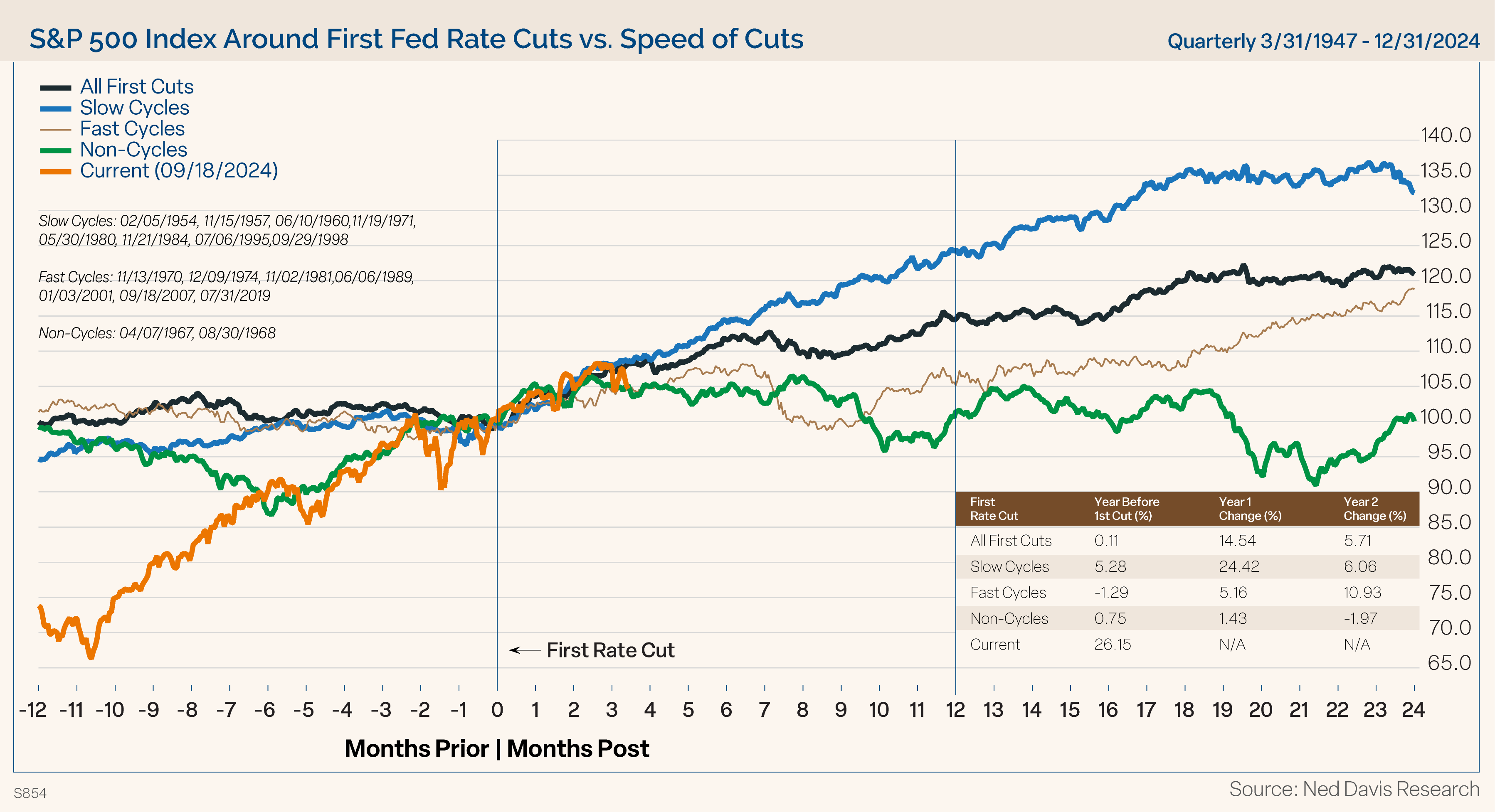

The market historically performs differently based on the pace at which the Fed cuts rates, as shown in Figure 11. Slow rate cut cycles are typically considered a policy recalibration done to maintain healthy economic activity. In those cases, the market averaged a gain of 24.4% one year later. Fast rate cut cycles occur when the economy is troubled and the markets require dramatic action. Gains one year later in those cases have typically been 5.1%.

Figure 11

This cycle may be different, though, considering that the S&P 500 gained more than 26% in total return the year preceding the first cut, much stronger than the average gain. Our previous belief that the rate-cutting cycle would act as a policy recalibration (like slow cycles) seems to hold, given the Fed’s messaging of slower rate cuts. However, we don’t foresee the market posting the gains seen historically during slow cycles, especially since the one-year before the first cut was more substantial than average. In our opinion, the market borrowed gains before the first cut.

High Yield Spreads

Recently, high yield bond indices traded at new all-time highs. Additionally, high yield and investment grade credit spreads are very tight and below their long-term average. This indicates little evidence of economic stress, a tailwind as we enter the new year. While credit spreads normally widen before economic stress, that is not the case currently, further aligning with our expectations for continued economic growth.

Credit markets aren’t fearful of borrowers’ ability to repay debts. The number of distressed high yield bonds has fallen dramatically, while investment grade credit spreads have been in the bottom 1% of readings for the past 20 years.

New issue supply was large in 2024, with $1.5 trillion of investment grade and $280 billion of high yield corporate debt issued. The market soaked it up, showing there is plenty of demand for bonds. 2025 issuance totals are set to increase, with an expected supply of $1.65 trillion and $340 billion, respectively.

Tariffs and Government Debt

Tariffs are nothing new. President George Washington implemented tariffs on his 68th day in office in 1789. Since then, tariffs have been used as a source of government revenue and a means to level the playing field on trade policy.

Today, there’s a lot of attention and concern surrounding the prospect of additional tariffs. China receives a lot of the attention regarding tariffs, largely because of the Chinese government’s anti-competitive practices. However, Mexico and Canada are the countries from which we import the most goods followed by Europe and then China. China represents about 18% of the goods imported into the U.S.

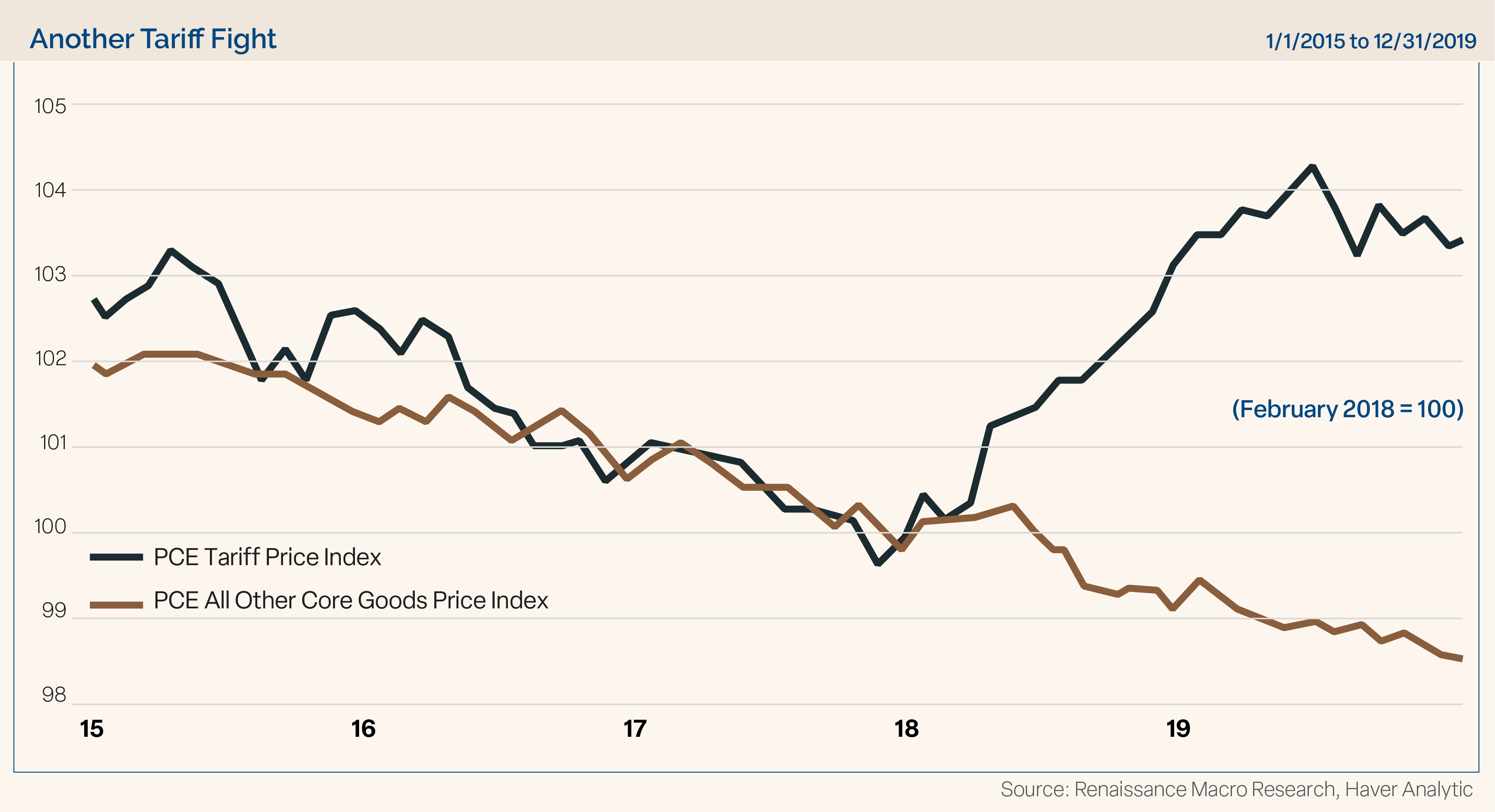

Another Tariff Fight

Trump increased import tariffs in July 2018. Inflation, as measured by CPI, was lower until the COVID supply chain disruption, and monetary and fiscal stimulus policies were enacted during the pandemic. Contrary to what many predicted then and even now, inflation did not increase due to higher tariffs.

Looking at actual price data, Figure 12 shows higher prices on the goods with tariffs, but lower prices for other goods without tariffs. Relatively speaking, prices were overall lower. CPI was 2.9% in July 2018 and 2.3% in December 2019, then Covid happened.

Figure 12

A question that nobody knows the answer to, except for maybe President Trump, is “Is the tariff threat for real or a negotiating tactic?” We believe that this is more of a tactic than a real bite. If additional tariffs are levied, they will likely be less than discussed on the campaign trail.

U.S. Government Debt and Stocks

The total outstanding U.S. government debt is at a record high, with interest expenses alone at $1 trillion annually. Congress hasn’t shown any desire to reign in the debt and deficits, regardless of who holds the White House.

This is a significant concern for investors as we are commonly asked “How will this impact the markets?” and “Does that matter to the market?” The answer is yes, it will eventually matter, but nobody knows when that Minsky moment will be. However, looking back at almost 60 years’ worth of data, debt to GDP in the U.S. tripled, increasing from 40% to 120%. Additionally, the S&P 500 increased from 90 to 5800 over that same period, a 64X multiple.

The debt load will matter when the demand for our Treasury securities is less than the supply, which is a major risk every time there is a Treasury auction. So far, demand has been there, but at these debt and deficit levels, every Treasury auction is a risk.

Taxes and Government Spending

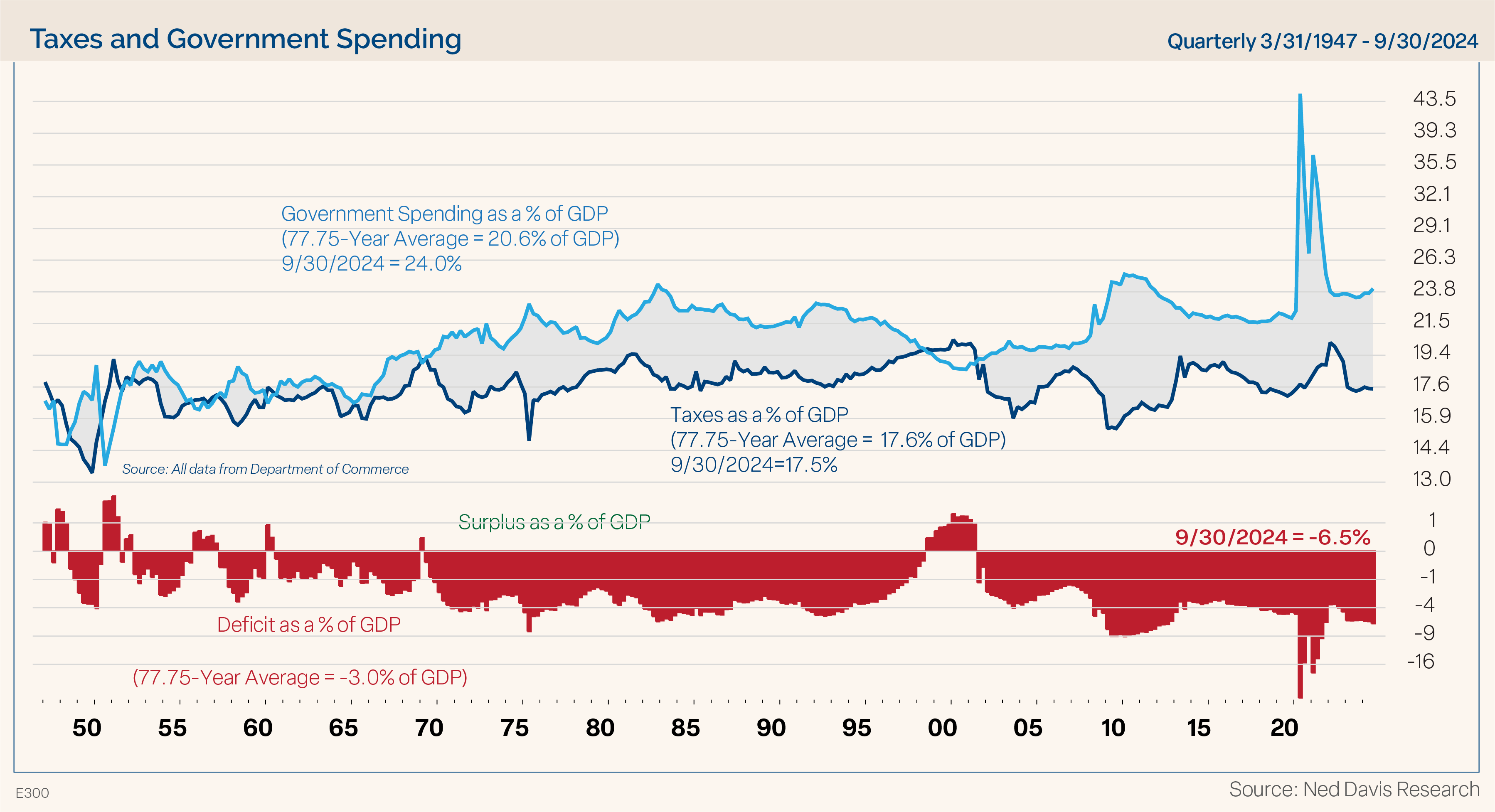

In Figure 13, are federal taxes, collections, and government spending as a percentage of GDP. The federal government is running deficits of over 6% of GDP. In the post-WWII era, government spending averaged 20.6% of GDP. It is currently at 24% of GDP, near the highest spending levels aside from the COVID pandemic. Meanwhile, taxes as a percentage of GDP have averaged 17.6% and are currently at 17.5%.

Figure 13

It is doubtful that the Department of Government Efficiency will meaningfully trim the size of spending to impact the deficit, especially given that Congress authorizes spending. It will be difficult for President Trump to achieve his agenda and pass controversial legislation with such a slim majority in Congress.

As a result, we have seen the bond vigilantes push Treasury yields higher. Our range for this year’s 10-year Treasury Note yield is between 3.5% and 5.0%. If it goes above 5.0%, we believe it would be temporary but would present a good buying point for bonds.

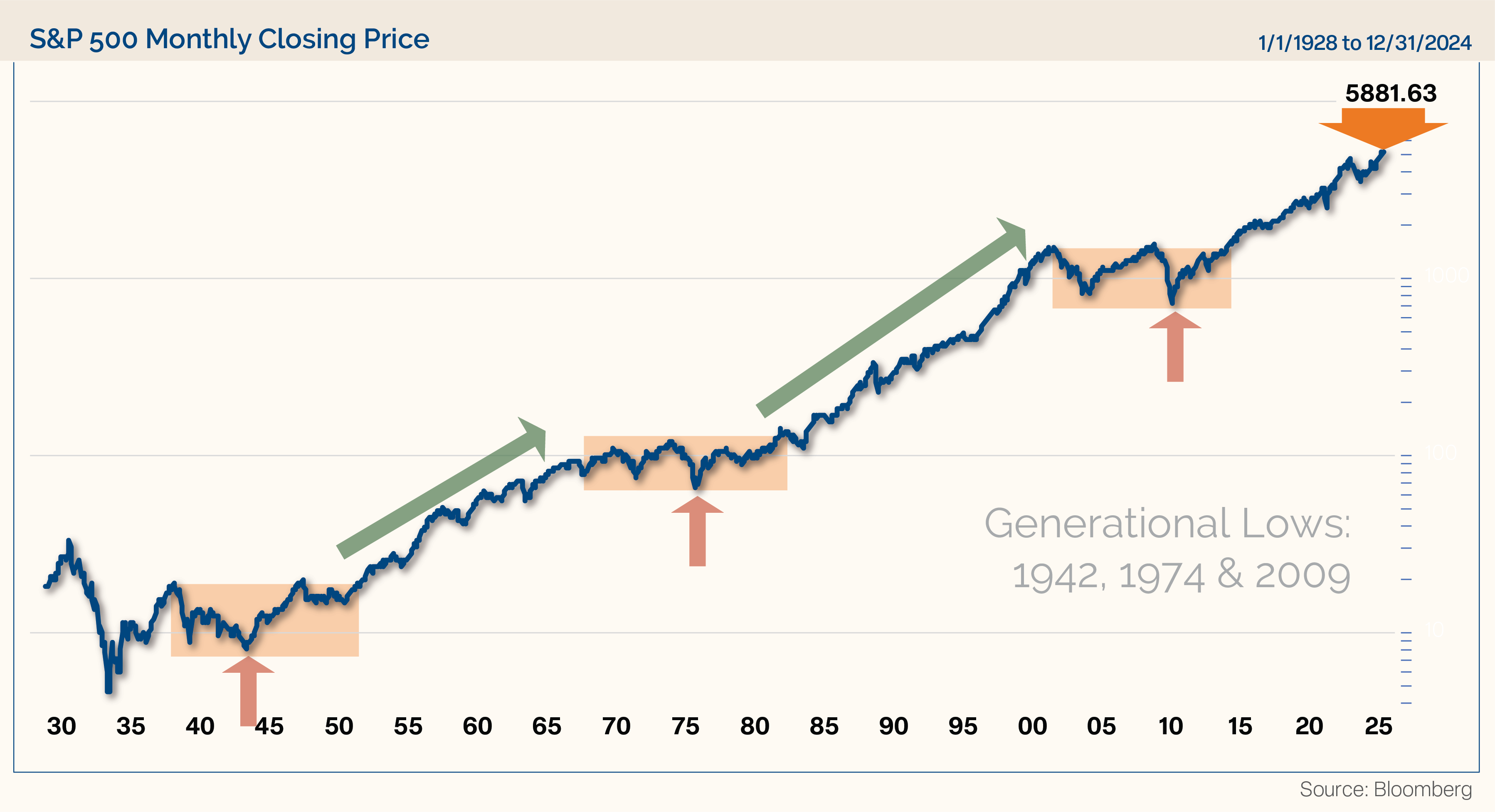

S&P 500 Monthly Closing Price

Figure 14 shows the market’s long-term trend. Since the global financial crisis ended, the markets have been in a secular bull market. We believe that the long-term bull market remains, but it is likely getting long in the tooth, and we would expect gains to moderate based on prior years.

Figure 14

Conclusion

Looking ahead to 2025, we see an economy underpinned by strong fundamentals and a market with many tailwinds. Animal spirits, deregulation, and pro-growth policies look to support economic expansion. When the fourth quarter GDP is reported, the economy will have posted growth for 11 consecutive quarters through 2024. We believe that the economy has the potential to continue growing by 2.50% in 2025.

Bullish trends include the first year of a President’s term, consecutive 20% or greater returns, and earnings momentum. Continued economic growth and new highs in corporate earnings suggest another year of gains for the market. Our year-end target for the S&P 500 is 6700 and we expect increased volatility in 2025.

After 100 basis points of rate cuts, the path of future cuts is set to slow as 2025 begins. The market is currently pricing in one rate cut this year, and we believe there will be two.

The 10-year Treasury Note yield should remain rangebound between 3.5% and 5.0%, with a path dependent on inflation and policy initiatives.

As always, the outlook is subject to risks. Some risks include echo inflation, policy uncertainty, tariffs, the valuation landscape, geopolitics (Russia/Ukraine, Middle East, China/Taiwan), and the U.S. government’s fiscal position.

Looking for More Insights? Visit Our Resource Center.

This document may contain certain information that constitutes forward-looking statements which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology (or the negative thereof). No assurance, representation, or warranty is made by any person that any of Clark Capital’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future.

Clark Capital Management Group, Inc. is an investment adviser registered with the U.S. Securities and Exchange. Commission Registration does not imply a certain level of skill or training. More information about Clark Capital’s advisory services can be found in its Form ADV which is available upon request.

The Barclays U.S. Corporate High-Yield Index covers the USD-denominated, non-investment grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Index returns include the reinvestment of income and dividends. The returns for these unmanaged indexes do not include any transaction costs, management fees or other costs. It is not possible to make an investment directly in any index.

Fixed income securities are subject to certain risks including, but not limited to: interest rate (changes in interest rates may cause a decline in market value or an investment), credit, prepayment, call (some bonds allow the issuer to call a bond for redemption before it matures), and extension (principal repayments may not occur as quickly as anticipated, causing the expected maturity of a security to increase).

Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities

The S&P 500 measures the performance of the 500 leading companies in leading industries of the U.S. economy, capturing 75% of U.S. equities.

The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values.

The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values.

The Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000 represents approximately 92% of the U.S. market.

The Russell 2000 Index measures the performance of the 2000 smallest U.S. companies based on total market capitalization in the Russell 3000, which represents approximately 10% of Russell 3000 total market capitalization.

The Russell 3000 Index measures the performance of the 3000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The MSCI Emerging Markets Index consists of the following 21 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

The MSCI World ex US Index is a market capitalization-weighted index designed to measure equity performance in 22 global developed markets, excluding the United States. The benchmark for this composite is used because the MSCI World Ex US Net Index is generally representative of international equities.

BBgBarc U.S. Aggregate Bond Index covers the U.S. investment-grade fixed-rate bond market, including government and credit securities, agency mortgage pass-through securities, asset-backed securities and commercial mortgage-based securities. To qualify for inclusion, a bond or security must have at least one year to final maturity, and be rated investment grade Baa3 or better, dollar denominated, non-convertible, fixed rate and publicly issued.

The BBgBarc US Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded by the maturity constraint but are part of a separate Short Treasury Index. STRIPS are excluded from the index because their inclusion would result in double-counting. The US Treasury Index is a component of the US Aggregate, US Universal, Global Aggregate and Global Treasury Indices.

The BBgBarc US Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD-denominated securities publicly issued by US and non-US industrial, utility and financial issuers. The US Corporate Index is a component of the US Credit and US Aggregate Indices, and provided the necessary inclusion rules are met, US Corporate Index securities also contribute to the multi-currency Global Aggregate Index.

The BBgBarc U.S. Corporate High-Yield Index covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

The BBgBarc U.S. Municipal Index covers the USD-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds and prerefunded bonds.

The Global Manufacturing PMI™ indices are all seasonally adjusted. The seasonal adjustment is applied at the national level (as opposed to at the global aggregate level) in order to account for differing seasonal patterns in each of the nations included. Global Manufacturing PMI™ indices are weighted according to national contributions to global manufacturing gross value added. Weights for the global indices are derived from the latest available World Bank data on the gross value added of manufacturing for each of the nations covered. World Bank data on value added are in constant 2010 US$, with all national currencies converted to 2010 US$ by the World Bank using DEC alternative conversion factors.

The NDR Credit Conditions Indices (CCI) are designed to objectively measure credit conditions in the U.S. market, specifically the cost & availability of credit. The index consists of two equal-weighted components and historically evaluates business and consumer credit conditions.

NDR (Ned Daily Research) Daily Trading Sentiment Index is based on the S&P 500 Daily Sentiment Index which shows a short-term sentiment view of the S&P 500 Index

Created by the Chicago Board Options Exchange (CBOE), the Volatility Index, or VIX, is a real-time market index that represents the market’s expectation of 30-day forward-looking volatility. Derived from the price inputs of the S&P 500 index options, it provides a measure of market risk and investors’ sentiments.

The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. A 10-year Treasury note pays interest at a fixed rate once every six months and pays the face value to the holder at maturity.

The Dow Jones Industrial Average is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The 30 stocks are chosen by the editors of the Wall Street Journal (which is published by Dow Jones & Company), a practice that dates back to the beginning of the century. The Dow is computed using a price-weighted indexing system, rather than the more common market cap-weighted indexing system.

Index returns include the reinvestment of income and dividends. The returns for these unmanaged indexes do not include any transaction costs, management fees or other costs. It is not possible to make an investment directly in any index.

The volatility (beta) of an account may be greater or less than its respective benchmark.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.