Mixed Month for Stocks, but Bonds Advance in August

HIGHLIGHTS:

- The broad indices were able to overcome a very rough start to the month with the S&P 500 Index closing August higher. Small and mid-cap stocks declined in August, while large-caps advanced.

- Bonds enjoyed gains for the fourth month in a row as rates continued to move lower. The 10-year U.S. Treasury yield ended July at 4.09% and it dropped to end August at 3.91%, hitting its lowest closing yield of the year (3.78%) during the month.

- The U.S. economy continued to show slowing economic activity. The ISM Manufacturing Index remained below 50 in July, but the Non-Manufacturing index bounced back to 51.4. The unemployment rate rose unexpectedly to 4.3% and helped spark a weak beginning to the month for equities.

- There was no FOMC meeting in August, but Fed Chairman Powells widely anticipated speech at Jackson Hole, Wyoming more-or-less secured the idea of a rate cut in September. The only debate (from a fed futures perspective based on the CME FedWatch tool) is whether the cut will be 25 or 50 basis points with the odds favoring a cut of 25 basis points as of early September.

EQUITY MARKETS

The month started off volatile for stocks. By early August, the S&P 500 had declined by about -8.5% from its recent high in mid-July. However, the panic seemed unwarranted at the time with fundamentals still solid. Markets steadily rebounded from that point for the rest of the month to turn in a positive gain for August. See Table 1 for equity results for August 2024, YTD and calendar year 2023.

Table 1

| Index | 24-Aug | YTD | 2023 |

| S&P 500 | 2.43% | 19.53% | 26.29% |

| S&P 500 Equal Weight | 2.50% | 12.53% | 13.87% |

| DJIA | 2.03% | 11.75% | 16.18% |

| Russell 3000 | 2.18% | 18.19% | 25.96% |

| NASDAQ Comp. | 0.74% | 18.57% | 44.64% |

| Russell 2000 | -1.49% | 10.39% | 16.93% |

| MSCI ACWI ex U.S. | 2.85% | 11.22% | 15.62% |

| MSCI Emerging Mkts Net | 1.61% | 9.55% | 9.83% |

The recent broadening of the market continued in August. Although the month was marked by large-cap strength once again, large-cap value companies outpaced their growth counterparts. Outside of small-caps, the NASDAQ Composite had the weakest results for the month. The leadership of large-cap growth still holds for the year to date, but small-caps, value stocks, and international companies have narrowed the gap in recent months.

We have often discussed the difference between the returns of the headline, market-cap-weighted S&P 500 Index compared to the equal-weighted version of the same stocks, which is more reflective of what the “average” stock is doing. The returns of these two measures were relatively in-line with each other in August, showing broader participation in the market.

The “average” stock had a better run in July and August, but large-caps still lead year to date. The same holds true that value stocks have had a better run in the last two months. Large value outperformed in July with one example being the Russell 1000 Value Index up 5.11% in July while the Russell 1000 Growth Index declined -1.70%. In August, those returns were 2.68% and 2.08% respectively as value progress continued.

Developed markets advanced and continue to show solid results so far this year, and emerging markets advanced as well, but not to the same degree. Emerging markets are the only index shown on Table 1 without a double-digit gain so far this year. Despite some volatility in August, and some potential volatility as we head towards the election, 2024 has been a strong year for equities to this point.

Fixed Income

After hitting the highest level of the year in April, the 10-year U.S. Treasury yield has declined for the last four months. In August, the 10-year yield hit a new low for 2024. This move lower in rates has helped set up generally positive returns for bonds during this period. Most bond sectors were able to push into positive territory after gains in July and additional gains were added in August. The 10-year U.S Treasury yield ended July at 4.09%. On August 1, the yield closed below 4% for the first time since February and it ended the month at 3.91%. See Table 2 for fixed income index returns for August 2024, year to date, and calendar year 2023.

Table 2

| Index | 24-Aug | YTD | 2023 |

| Bloomberg U.S. Agg | 1.44% | 3.07% | 5.53% |

| Bloomberg U.S. Credit | 1.55% | 3.46% | 8.18% |

| Bloomberg U.S. High Yld | 1.63% | 6.29% | 13.44% |

| Bloomberg Muni | 0.79% | 1.30% | 6.40% |

| Bloomberg 30-year U.S. TSY | 2.35% | -0.49% | 1.93% |

| Bloomberg U.S. TSY | 1.28% | 2.60% | 4.05% |

The more rate-sensitive sectors (like longer-dated U.S. Treasuries) showed the best results in August as rates continued to drop, but the 30-year U.S. Treasury Index is still negative so far this year. High yield bonds often follow what is happening with stocks, so they posted another solid month of gains in August and have the best results of the bond indices year to date. At the start of the year, we said we thought the 10-year U.S. Treasury yield would be in a range between 3.25% and 4.5% in 2024 (acknowledging that we got above that level in April).

The trend in rates has been lower since those April highs, and we believe rates will continue to decline through the second half of this year. Furthermore, as the Fed likely begins to cut rates in September, we believe front end rates could start to decline rather dramatically after remaining stubbornly high so far this year.

We maintain our long-standing position favoring credit versus pure rate exposure in this interest rate environment. We also believe the role bonds play in a portfolio, to provide stable cash flow and to help offset the volatility of stocks in the long run, has not changed. Furthermore, we believe that bond yields remain attractive, and we are seeing some of the best bond yields in years. In our opinion, having an active bond management approach makes sense in these volatile times.

Economic Data Highlights and Outlook

The soft-landing scenario seems to be developing in the U.S. economy. Data released in August (largely covering July), continued to point to weaker economic growth. However, the second reading of Q2 2024 GDP showed an increase to 3.0% annualized growth from the initial reading and expectations of 2.8%. The Atlanta Fed GDPNow estimate for economic growth (as of September 4) shows the economy running at an estimated 2.1% annualized growth rate for the third quarter. That is right around our GDP growth expectation for all of 2024 at 2.25%. We do expect growth to slow in 2024, but we also think the odds favor a soft landing and not a recession at this point.

The markets soft-landing scenario seemed to be replaced by the idea of an imminent recession in the first few trading days of August set off by a weak job market report. Non-farm payrolls grew by 114,000 in July, below expectations of 175,000. Furthermore, the unemployment rate rose unexpectedly to 4.3%, when it was expected to remain at the prior months level of 4.1%.

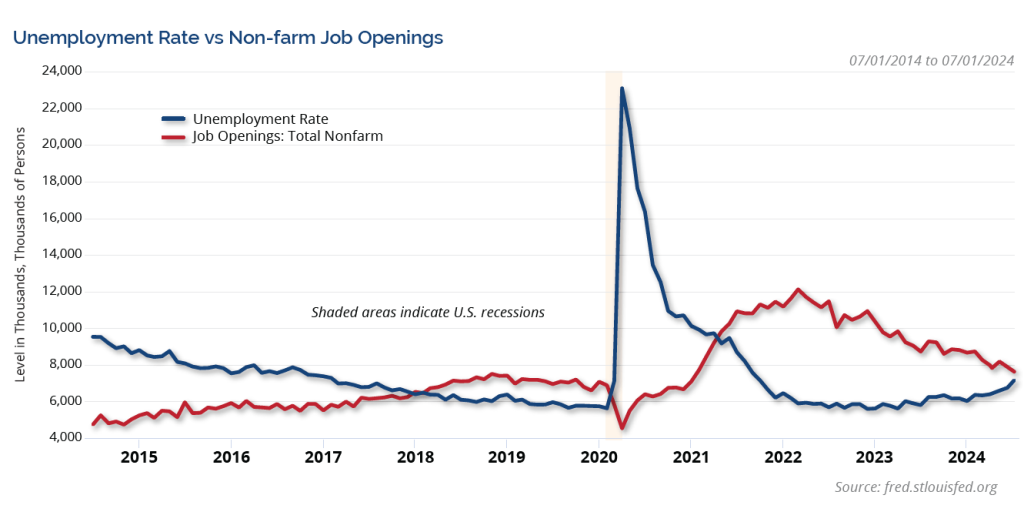

The 4.3% reading was the highest since October 2021 and is just under a full percentage point off the recent low of 3.4% in April 2023. However, by definition, a soft landing means weaker economic data, so this weakening in the job market has not been surprising from our perspective, nor has it changed our expectation of a weaker, but still growing economy in 2024. Moderation in the job market is not unexpected and could allow the Fed to cut rates, which seems to be imminent at the September FOMC meeting. Job openings still outnumber the unemployed, but that gap has narrowed. Chart 1 shows the number of unemployed people in the U.S. compared to job openings.

Chart 1

For illustrative purposes only.

The ratio of job openings compared to the number of people unemployed has now dropped below 1.1. Tighter labor market conditions exist and with the Feds dual mandate consisting of price stability and full employment, the weaker job market would support the Fed beginning to cut rates.

Overall, we would still view the job market as healthy and coming more into balance. It seems unlikely that the economy would slow too drastically with the current position of the labor market. We continue to expect that the economy will slow from its pace in 2023, but that it will still grow in 2024 resulting in a soft landing. Even if a recession developed, we believe it would be mild due to the strength of the consumer. We believe opportunities exist in the stock and bond markets under either a slow growth or mild recession scenario, but we believe the odds favor a soft landing at this point.

The other side of the Feds dual mandate continues to improve. The Consumer Price Index (CPI) rose as expected by 0.2% in July, but the annual increase was at 2.9%, below expectations and the prior months level of 3.0%. The core CPI readings matched both monthly and annual expectations at 0.2% and 3.2%, respectively. Both headline and core Producer Price Index (PPI) readings were better (lower) than expected in July. Rounding out the inflation readings for July, the preferred inflation measure of the Fed, the Personal Consumption Expenditures (PCE) Price Index largely matched expectations. The headline PCE Index had an annual increase of 2.5% in July after a 0.2% monthly gain as expected. The core PCE reading (the reading the Fed targets) was 2.6% on an annual basis after rising an expected 0.2% for the month. The annual increase was better than expectations of 2.7% and matched the level from last month. Chart 2 shows the headline and core PCE Price Indices.

Chart 2

With inflation improving and the job market showing some recent weakening, the market is now anticipating rate cuts to begin at the September FOMC meeting. The CME FedWatch Tool shows a 57% probability of a 25-basis point cut and a 43% probability of a 50-basis point cut at the September meeting (as of 9/4) and the odds favor a year end Fed Funds rate a full percentage point lower than its current position. Chairman Powell laid the groundwork for rate cuts to begin at the press conference following the July FOMC meeting and reiterated those expectations during his Jackson Hole speech.

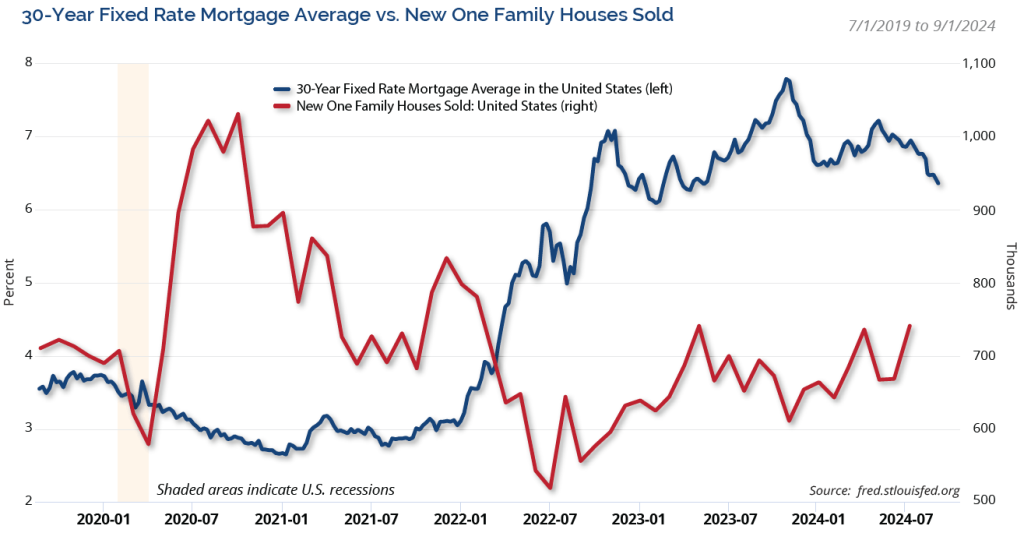

The housing market was mixed in July, but the general drop in rates seems to be creating a better backdrop for housing overall. Housing starts and building permits both missed expectations and both were lower in July compared to June. However, existing home sales modestly surpassed estimates and new home sales were much stronger than expected with both readings improving on Junes levels. The S&P CoreLogic 20-City Index of home prices rose by 6.47% on an annual basis in June, ahead of expectations of 6.14% but below the prior months annual increase of 6.88%. Mortgage rates tend to follow what is happening with the 10-year U.S Treasury, so the recent decline in Treasury yields should keep the trend moving lower for mortgages rates as well. Chart 3 shows how new home sales appear to be trending higher as mortgage rates have been trending lower.

Chart 3

The ISM indices were mixed in July. The ISM Manufacturing Index slumped even further for the month to 46.8 compared to expectations of 48.8 and the prior level of 48.5. Manufacturing seems to be in contraction mode. (This index improved modestly in August to 47.2, but expectations were at 47.5 and the reading remains well below the expansion/contraction dividing line of 50). The ISM Non-Manufacturing Index, which covers the much larger service industries in the U.S. economy, rebounded after a surprising and disappointing reading in June of 48.8. For July, this index improved to 51.4, modestly surpassing expectations of 51.0 and moving back into expansionary territory. On a positive note for this index, new orders picked up in July above 52 after being below 50 in June.

Retail sales (ex. auto and gas) at a 0.4% monthly gain were twice as strong as expectations of 0.2%. The preliminary University of Michigan Sentiment reading for August improved modestly to 67.8 from 66.4 and expectations of 66.9. After breaking a two-year streak of declines in February, the Conference Boards Leading Index has now declined for five straight months. For July, it fell -0.6%, worse than the expected -0.4% drop.

The first few trading days in August were among the most volatile we have seen in some time. Set off by weaker job market data, we believed the market was overreacting. A soft landing, by definition, means economic data will be weakening and that is largely what we have seen. Economic data so far has not been overly surprising from our perspective. The volatility was also likely exacerbated by the shift in market leadership in recent months. After a multi-year stretch when large-cap growth has for the most part dominated the market, July and August saw other areas participate — like small and mid-caps, value stocks and international markets. Generally speaking, we believe more breadth in the market would be a healthy improvement moving forward.

Equity market volatility helped bonds rally and yields have dropped sharply in recent months. We maintain our belief that the economy will grow in 2024, but at a more muted pace than last year and that seems to be developing. The good news is that currently, earning expectations for 2024 and 2025 are for double-digit growth, but that is obviously subject to revision. As always, we believe it is imperative for investors to stay focused on their long-term goals and not let short-term swings in the market derail them from their longer-term objectives.

Investment Implications

Clark Capitals Top-Down, Quantitative Strategies

On August 5th, the CBOE Volatility Index (VIX) surged to its third highest intraday level on record, with higher levels reached only during the 2008 Global Financial Crisis and early 2020 during the COVID market meltdown. However, our credit models remained very bullish, indicating to us that Augusts decline was just a correction, and not the start of deeper market selloff.

Clark Capitals Bottom-Up, Fundamental Strategies

Business momentum among the largest stocks continues to push both 12-month earnings estimates and prices to new highs. In our view, the relative attractiveness of small-cap, SMID-cap, and international equities is intact. We believe the current environment provides investors an opportunity to true-up their asset allocation and create greater diversification among equity classes.

ECONOMIC DATA

| Event | Period | Estimate | Actual | Prior | Revised |

| ISM Manufacturing | July | 48.8 | 46.8 | 48.5 | — |

| ISM Services Index | July | 51 | 51.4 | 48.8 | — |

| Change in Nonfarm Payrolls | July | 175k | 114k | 206k | 179k |

| Unemployment Rate | July | 4.10% | 4.30% | 4.10% | — |

| Average Hourly Earnings YoY | July | 3.70% | 3.60% | 3.90% | 3.80% |

| JOLTS Job Openings | July | 8100k | 7673k | 8184k | 7910k |

| PPI Final Demand MoM | July | 0.20% | 0.10% | 0.20% | — |

| PPI Final Demand YoY | July | 2.30% | 2.20% | 2.60% | 2.70% |

| PPI Ex Food and Energy MoM | July | 0.20% | 0.00% | 0.40% | 0.30% |

| PPI Ex Food and Energy YoY | July | 2.60% | 2.40% | 3.00% | — |

| CPI MoM | July | 0.20% | 0.20% | -0.10% | — |

| CPI YoY | July | 3.00% | 2.90% | 3.00% | — |

| CPI Ex Food and Energy MoM | July | 0.20% | 0.20% | 0.10% | — |

| CPI Ex Food and Energy YoY | July | 3.20% | 3.20% | 3.30% | — |

| Retail Sales Ex Auto and Gas | July | 0.20% | 0.40% | 0.80% | — |

| Industrial Production MoM | July | -0.30% | -0.60% | 0.60% | 0.30% |

| Building Permits | July | 1425k | 1396k | 1446k | 1454k |

| Housing Starts | July | 1333k | 1238k | 1353k | 1329k |

| New Home Sales | July | 623k | 739k | 617k | 668k |

| Existing Home Sales | July | 3.94m | 3.95m | 3.89m | 3.90m |

| Leading Index | July | -0.40% | -0.60% | -0.20% | — |

| Durable Goods Orders | July P | 5.00% | 9.90% | -6.70% | -6.90% |

| GDP Annualized QoQ | 2Q S | 2.80% | 3.00% | 2.80% | — |

| U. of Mich. Sentiment | Aug P | 66.9 | 67.8 | 66.4 | — |

| Personal Income | July | 0.20% | 0.30% | 0.20% | — |

| Personal Spending | July | 0.50% | 0.50% | 0.30% | — |

| S&P CoreLogic CS 20-City YoY NSA | June | 6.14% | 6.47% | 6.81% | 6.88% |

Source: Bloomberg: P=Preliminary, S=Secondary Reading

Past performance is not indicative of future results. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Material presented has been derived from sources considered to be reliable and has not been independently verified by us or our personnel. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, other investments or to adopt any investment strategy or strategies. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Investing involves risk, including loss of principal.

Clark Capital Management Group is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Clark Capital Management Group’s advisory services can be found in its Form ADV which is available upon request.

Fixed income securities are subject to certain risks including, but not limited to: interest rate (changes in interest rates may cause a decline in market value or an investment), credit, prepayment, call (some bonds allow the issuer to call a bond for redemption before it matures), and extension (principal repayments may not occur as quickly as anticipated, causing the expected maturity of a security to increase).

Clark Capital utilizes a proprietary investment model to assist with the construction of the strategy and to assist with making investment decisions. Investments selected using this process may perform differently than expected as a result of the factors used in the model, the weight placed on each factor, and changes from the factors historical trends. There is no guarantee that Clark Capital’s use of a model will result in effective investment decisions.

Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

Foreign securities are more volatile, harder to price and less liquid than U.S. securities. They are subject to different accounting and regulatory standards and political and economic risks. These risks are enhanced in emerging market countries.

The value of investments, and the income from them, can go down as well as up and you may get back less than the amount invested.

Equity securities are subject to price fluctuation and possible loss of principal. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). Strategies that concentrate their investments in limited sectors are more vulnerable to adverse market, economic, regulatory, political, or other developments affecting those sectors.

JOLTS is a monthly report by the Bureau of Labor Statistics (BLS) of the U.S. Department of Labor counting job vacancies and separations, including the number of workers voluntarily quitting employment.

The Core Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

The Core Producer Price Index (PPI) program measures the average change over time in the selling prices received by domestic producers for their output. The prices included in the PPI are from the first commercial transaction for many products and some services.

The PCE price index, released each month in the Personal Income and Outlays report, reflects changes in the prices of goods and services purchased by consumers in the United States.

Earnings per share (EPS) is a company’s net profit divided by the number of common shares it has outstanding.

References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time (each, an index) are provided for your information only. Reference to an index does not imply that the portfolio will achieve returns, volatility or other results similar to that index. The composition of the index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Investors cannot invest directly in an index.

The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities.

The Bloomberg Barclays U.S. Municipal Index covers the USD-denominated long-term tax exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds and prerefunded bonds.

The Bloomberg US Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded by the maturity constraint, but are part of a separate Short Treasury Index.

The Dow Jones Industrial Average indicates the value of 30 large, publicly owned companies based in the United States.

The NASDAQ Composite is a stock market index of the common stocks and similar securities listed on the NASDAQ stock market.

The S&P 500 measures the performance of the 500 leading companies in leading industries of the U.S. economy, capturing 80% of U.S. equities.

The S&P 500® Equal Weight Index (EWI) is the equal-weight version of the widely-used S&P 500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight — or 0.2% of the index total at each quarterly rebalance.

The University of Michigan Consumer Sentiment Index rates the relative level of current and future economic conditions. There are two versions of this data released two weeks apart, preliminary and revised. The preliminary data tends to have a greater impact. The reading is compiled from a survey of around 500 consumers.

The Russell 1000 Index is a stock market index that tracks the highest-ranking 1,000 stocks in the Russell 3000 Index, which represent about 93% of the total market capitalization of that index.

The iShares Russell 1000 Growth ETF seeks to track the investment results of an index composed of large- and mid-capitalization U.S. equities that exhibit growth characteristics.

The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values.

The Russell 2000 Index is a small-cap stock market index that represents the bottom 2,000 stocks in the Russell 3000.

The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

Nonfarm payrolls (NFPs) are the measure of the number of workers in the United States excluding farm workers and workers in a handful of other job classifications.

A municipal bond, commonly known as a muni, is a bond issued by state or local governments, or entities they create such as authorities and special districts.

The U.S. Treasury index is based on the recent auctions of U.S. Treasury bills. Occasionally it is based on the U.S. Treasury’s daily yield curve.

The 30 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 30 years.

The 10 Year Treasury Yield is the yield received for investing in a US government issued treasury security that has a maturity of 10 year. The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the risk free rate when valuing the markets or an individual security.

The Bloomberg Barclays U.S. Corporate High-Yield Index covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

The Bloomberg Barclays U.S. Credit Index measures the investment grade, U.S. dollar denominated, fixed-rate taxable corporate and government related bond markets.

The Bloomberg Aggregate Bond Index or the Agg is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance.

The Bloomberg US Trsy Bellwethers 30Y is a U.S. Treasury debt obligation that has a maturity of 30 years.

The ISM Non-Manufacturing Index is an index based on surveys of more than 400 non-manufacturing firms purchasing and supply executives, within 60 sectors across the nation, by the Institute of Supply Management (ISM). The ISM Non-Manufacturing Index tracks economic data, like the ISM Non-Manufacturing Business Activity Index. A composite diffusion index is created based on the data from these surveys, that monitors economic conditions of the nation.

ISM Manufacturing Index measures manufacturing activity based on a monthly survey, conducted by Institute for Supply Management (ISM), of purchasing managers at more than 300 manufacturing firms.

The MSCI Emerging Markets Index captures large and mid cap representation across 27 Emerging Markets (EM) countries.

The MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 Developed Markets (DM) countries (excluding the US) and 27 Emerging Markets (EM) countries*. With 2,359 constituents, the index covers approximately 85% of the global equity opportunity set outside the US

The S&P CoreLogic Case-Shiller 20-City Composite Home Price NSA Index seeks to measures the value of residential real estate in 20 major U.S. metropolitan areas. The U.S. Treasury index is based on the recent auctions of U.S. Treasury bills. Occasionally it is based on the U.S. Treasury’s daily yield curve.

The Leading Economic Index provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term.

In the United States, the Core Personal Consumption Expenditure Price (CPE) Index provides a measure of the prices paid by people for domestic purchases of goods and services, excluding the prices of food and energy.

The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPX?) call and put options. On a global basis, it is one of the most recognized measures of volatility — widely reported by financial media and closely followed by a variety of market participants as a daily market indicator.

The Conference Board’s Leading Indexes are the key elements in an analytic system designed to signal peaks and troughs in the business cycle. The leading, coincident, and lagging economic indexes are essentially composite averages of several individual leading, coincident, or lagging indicators. They are constructed to summarize and reveal common turning point patterns in economic data in a clearer and more convincing manner than any individual component primarily because they smooth out some of the volatility of individual components.

Gross domestic product (GDP) is the standard measure of the value added created through the production of goods and services in a country during a certain period.