Muted Stock Returns but Solid Bond Gains in November as Government Shutdown Finally Ends

HIGHLIGHTS:

- Stocks: A late-month rally drove the S&P 500 and Dow Jones Industrial Average to modest gains in November, while the Nasdaq Composite and, more broadly, growth stocks declined.

- Bonds: Rates generally drifted lower in November ending at 4.02%, a good backdrop for bond results.

- U.S. Economy: Government data was still largely absent in November, but some reports were released later in the month.

- Federal Reserve: The FOMC held no meetings in November. Markets strongly favored another rate cut at the December FOMC meeting based on the CME FedWatch tool as of December 1, 2025. This cut would be the third this year.

Equity Markets

After experiencing a modest 5% correction, equities generally recovered in the latter part of November, but final results were ultimately mixed. See Table 1 for November 2025 and YTD returns.

Table 1 | Equity Markets

| Index | November | YTD |

|---|---|---|

| S&P 500 | 0.25% | 17.81% |

| S&P 500 Equal Weight | 1.90% | 10.93% |

| DJIA | 0.48% | 13.88% |

| Russell 3000 | 0.27% | 17.17% |

| NASDAQ Comp. | -1.45% | 21.71% |

| Russell 2000 | 0.96% | 13.47% |

| MSCI ACWI ex U.S. | -0.03% | 28.53% |

| MSCI Emerging Mkts Net | -2.39% | 29.69% |

Although volatile, the major stock indices ended November without significant changes. The Nasdaq Composite Index, the weakest U.S. index in November, fell less than -1.5%, and the largest gainer, the equal-weighted S&P 500 Index, rose less than 2%. The S&P 500, Dow Jones Industrial Average, Russell 3000, and Russell 2000 indices all gained less than 1% for the month. While subtle, large-cap growth paused in November and had some of the weakest results, while both large- and small-cap value stocks turned in positive gains. Better results for the equal-weighted S&P 500 Index compared to the S&P 500, reflected the rally broadening beyond just the largest cap tech names. Year to date, large-cap growth has still clearly led in U.S. stocks, but small caps and value stocks closed the gap modestly last month. Stocks have recovered strongly from their April lows with double-digit year-to-date gains across the board on Table 1.

The MSCI ACWI ex U.S. Index, the broad measure of international stocks, was more-or-less flat in November, while emerging markets were the weakest of any of the equity indices on Table 1 declining -2.39%. Despite that decline, emerging markets still have the strongest year-to-date results, and both measures of international stocks are well ahead of their U.S. counterparts in 2025 after underperforming for much of the last 15 years. Following the April lows, stocks have had an impressive rally with little weakness along the way. It is imperative to remember that stocks can be volatile, and pullbacks like the ones we experienced in November are not unusual.

Fixed Income

Bonds continued their solid year with another month of good returns in November. After an initial move higher, rates generally declined during the month, which led to a positive backdrop for most bonds. See Table 2 for bond index returns for November 2025 and YTD.

Table 2 | Fixed Income Markets

| Index | November | YTD |

|---|---|---|

| Bloomberg U.S. Agg | 0.62% | 7.46% |

| Bloomberg U.S. Credit | 0.62% | 8.04% |

| Bloomberg U.S. High Yld | 0.58% | 8.01% |

| Bloomberg Muni | 0.23% | 4.15% |

| Bloomberg 30-year U.S. TSY | 0.27% | 5.99% |

| Bloomberg U.S. TSY | 0.62% | 6.67% |

The 10-year U.S. Treasury yield closed at 4.17% on November 5, marking its high close for the month. From that point, yields slipped lower and created a positive backdrop for most bond sectors, which continued the trend in recent months of rates moving lower. The recent outperformance of munis faded somewhat in November, but results were still positive. The results of the Agg, Credit, High Yield and Treasury indices were all within four basis points of each other, reflecting broad gains in bonds last month. In general, bonds have done their job in 2025, posting solid gains and helping to offset some of the equity market volatility.

We maintain our long-standing position favoring credit versus pure rate exposure in this interest rate environment. Credit spreads have remained near historic lows as corporate bonds have outperformed Treasuries so far this year. We also believe the role bonds play in a portfolio, to provide stable cash flow and to help offset the volatility of stocks in the long run, has not changed. As the Fed resumes its rate-cutting cycle, we believe having an active bond management approach makes sense. Furthermore, rates remain elevated and provide attractive opportunities for bond investors.

Economic Data Highlights and Outlook

Our comments will be limited in this section as the government shutdown resulted in most economic data not being compiled or released. With that said, we will highlight a few releases of note.

The September Producer Price Index (PPI) was released in late November. The headline PPI increased 0.3% as expected for the month and the core reading (excluding food and energy prices) increased only 0.1% compared to estimates at 0.2%. On a year-over-year basis, the readings increased 2.7% and 2.6%, respectively. The headline reading was 0.1% higher than expected, and the core reading was 0.1% lower than expected.

Recall that CPI was released in October for September since this reading was needed by law to make cost of living adjustments. The core and headline year-over-year increases through September came in at 3.0%. It appears the Bureau of Labor Statistics (BLS) will not release October inflation data and will instead resume CPI releases covering November on December 18 (per the BLS website).

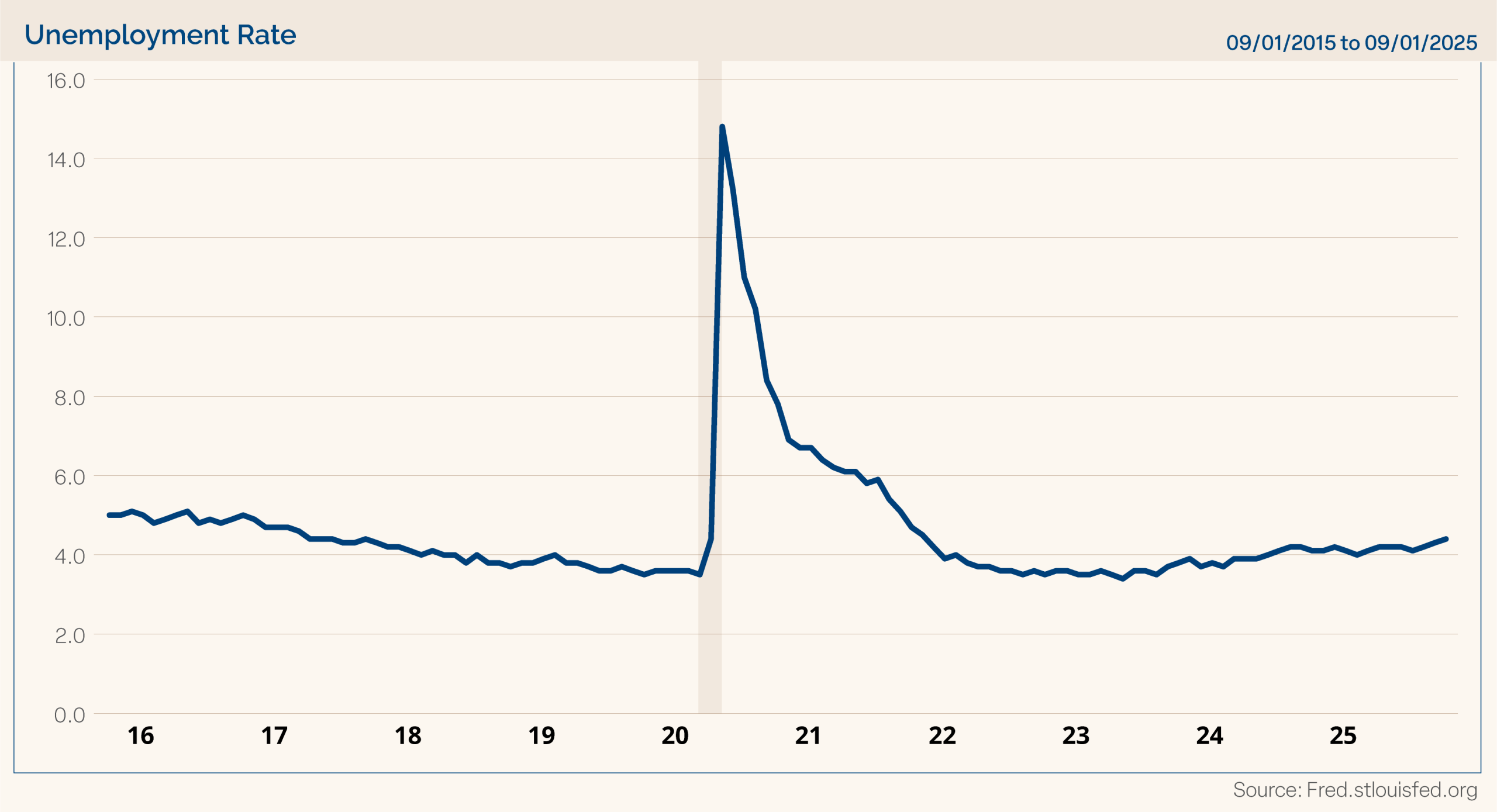

Payroll data for September showed 119,000 job additions, easily surpassing the estimate of 53,000, but August payrolls were revised to show a decline of -4,000 jobs compared to an initial release of 22,000 additions. The unemployment rate did increase to 4.4% in September, which was higher than expectations and the prior reading of 4.3%. This was the highest unemployment rate since coming out of the pandemic in 2021. (The October and November job market readings are both expected to be released on December 16). Please see Chart 1 below showing the gradually rising unemployment rate.

Chart 1

The Institute for Supply Management (ISM) Manufacturing Index continued to reflect contraction, with a reading of 48.2 in November on the heels of a disappointing 48.7 reading in October. The ISM Non-Manufacturing Index, which covers the much larger service industries in the U.S. economy, was a spot of good news coming in at 52.4 in October, which was higher than expectations of 50.8 and improved from September’s level of 50.0. New orders were significantly stronger than expected in October (56.2 vs. 51.0). Recall for the ISM indices, readings above 50 represent expansion and below 50 reflect contraction.

The preliminary University of Michigan Consumer Sentiment survey for November dropped to 50.3 compared to expectations of 53.0 and the final October level of 53.6. After recovering in early summer from very pessimistic levels following the tariff announcements in April and May, consumer sentiment has slid lower from late summer and into fall.

Finally, the Atlanta Fed GDP Now estimate shows expected Q3 2025 growth to come in at a 3.9% annualized pace (as of December 1, 2025), which would surpass the strong final growth rate of 3.8% in the second quarter. However, with the government shutdown, the preliminary reading of Q3 GDP was not reported at the end of October as it was originally scheduled and is now expected to be released December 23, per the Bureau of Economic Analysis (BEA) website.

The Federal Reserve did not meet in November. After two straight meetings with rate cuts in September and October, the odds of a rate cut at the December 9-10 meeting moved around sharply during the month. Chair Powell’s press conference comments after the October FOMC meeting were somewhat hawkish and caused the market to reassess the speed of this rate cut cycle. However, moving into December, the odds once again strongly favored a rate cut at the final FOMC meeting of 2025 with an 87.4% probability per the CME FedWatch tool on December 1, 2025. This final FOMC meeting of 2025 will also be accompanied with new economic projections by Fed officials—the so-called dot plots—so it will provide market participants with plenty of information to digest going into the end of the year.

Markets have proven to be strong for most of the year. From tariff uncertainty to a record-long government shutdown, equity markets have been able to climb the “wall of worry” and ascend to new all-time highs. It will take some time for government economic releases to get back on schedule, but December begins that process. Stock valuations have crept higher and sit at elevated levels. However, valuations have not grown too alarming in our opinion and are supported by record high earnings and accelerating growth. In our opinion, we still see opportunities in the stock market as we close out 2025, and bond yields still provide opportunities in fixed income despite moving lower recently. As always, we believe it is imperative for investors to stay focused on their long-term goals and not let short-term swings in the market derail them from their longer-term objectives.

Please Note: Items highlighted in blue in the table below have not been updated since the prior month due to the government shutdown and updates to those prior readings not being available.

Economic Data

| Event | Period | Estimate | Actual | Prior | Revised |

|---|---|---|---|---|---|

| ISM Manufacturing | Oct | 49.5 | 48.7 | 49.1 | — |

| ISM Services Index | Oct | 50.8 | 52.4 | 50 | — |

| Change in Nonfarm Payrolls | Sept | 53k | 119k | 22k | -4k |

| Unemployment Rate | Sept | 4.30% | 4.40% | 4.30% | — |

| Average Hourly Earnings YoY | Sept | 3.70% | 3.80% | 3.70% | 3.80% |

| JOLTS Job Openings | Aug | 7200k | 7227k | 7181k | 7208k |

| PPI Final Demand MoM | Sept | 0.30% | 0.30% | -0.10% | — |

| PPI Final Demand YoY | Sept | 2.60% | 2.70% | 2.60% | 2.70% |

| PPI Ex Food and Energy MoM | Sept | 0.20% | 0.10% | -0.10% | — |

| PPI Ex Food and Energy YoY | Sept | 2.70% | 2.60% | 2.80% | 2.90% |

| CPI MoM | Sept | 0.40% | 0.30% | 0.40% | — |

| CPI YoY | Sept | 3.10% | 3.00% | 2.90% | — |

| CPI Ex Food and Energy MoM | Sept | 0.30% | 0.20% | 0.30% | — |

| CPI Ex Food and Energy YoY | Sept | 3.10% | 3.00% | 3.10% | — |

| Retail Sales Ex Auto and Gas | Sept | 0.30% | 0.10% | 0.70% | 0.60% |

| Industrial Production MoM | Aug | -0.10% | 0.10% | -0.10% | -0.40% |

| Building Permits | Aug P | 1370k | 1312k | 1362k | __ |

| Housing Starts | Aug | 1365k | 1307k | 1428k | 1429k |

| New Home Sales | Aug | 650k | 800k | 652k | 664k |

| Existing Home Sales | Oct | 4.08m | 4.10m | 4.06m | 4.05m |

| Leading Index | Aug | -0.20% | -0.50% | -0.10% | 0.10% |

| Durable Goods Orders | Sept P | 0.50% | 0.50% | 2.90% | 3.00% |

| GDP Annualized QoQ | 2Q T | 3.30% | 3.80% | 3.30% | — |

| U. of Mich. Sentiment | Nov P | 53 | 50.3 | 53.6 | — |

| Personal Income | Aug | 0.30% | 0.40% | 0.40% | __ |

| Personal Spending | Aug | 0.50% | 0.60% | 0.50% | __ |

| S&P Cotality CS 20-City YoY NSA | Sept | 1.40% | 1.36% | 1.58% | 1.57% |

Source: Bloomberg; P=Preliminary, T=Third Reading.

Forward looking statements cannot be guaranteed. Past performance is not indicative of future results. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Material presented has been derived from sources considered to be reliable and has not been independently verified by us or our personnel. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, other investments or to adopt any investment strategy or strategies. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Investing involves risk, including loss of principal.

Clark Capital Management Group is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Clark Capital Management Group’s advisory services can be found in its Form ADV and/or Form CRS, which are available upon request.

The manager utilizes a proprietary investment model to assist with the construction of the strategy and to assist the manager with making investment decisions. Investments selected using this process may perform differently than expected as a result of the factors used in the model, the weight placed on each factor, and changes from the factors’ historical trends. There is no guarantee that Clark Capital’s use of a model will result in effective investment decisions.

Fixed income securities are subject to certain risks including, but not limited to: interest rate (changes in interest rates may cause a decline in market value or an investment), credit, prepayment, call (some bonds allow the issuer to call a bond for redemption before it matures), and extension (principal repayments may not occur as quickly as anticipated, causing the expected maturity of a security to increase).

Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

The value of investments, and the income from them, can go down as well as up and you may get back less than the amount invested.

Equity securities are subject to price fluctuation and possible loss of principal. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). Strategies that concentrate their investments in limited sectors are more vulnerable to adverse market, economic, regulatory, political, or other developments affecting those sectors.

JOLTS is a monthly report by the Bureau of Labor Statistics (BLS) of the U.S. Department of Labor counting job vacancies and separations, including the number of workers voluntarily quitting employment.

The Core Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

The Core Producer Price Index (PPI) program measures the average change over time in the selling prices received by domestic producers for their output. The prices included in the PPI are from the first commercial transaction for many products and some services.

The PCE price index, released each month in the Personal Income and Outlays report, reflects changes in the prices of goods and services purchased by consumers in the United States.

References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time (each, an “index”) are provided for your information only. Reference to an index does not imply that the portfolio will achieve returns, volatility or other results similar to that index. The composition of the index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Investors cannot invest directly in an index.

The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies.

The index covers all industries except transportation and utilities.

The Bloomberg Barclays U.S. Municipal Index covers the USD-denominated long-term tax exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds and prerefunded bonds.

The Bloomberg US Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded by the maturity constraint, but are part of a separate Short Treasury Index.

The NASDAQ Composite is a stock market index of the common stocks and similar securities listed on the NASDAQ stock market.

The S&P 500 measures the performance of the 500 leading companies in leading industries of the U.S. economy, capturing 80% of U.S. equities.

The S&P 500® Equal Weight Index (EWI) is the equal-weight version of the widely-used S&P 500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight or 0.2% of the index total at each quarterly rebalance.

The University of Michigan Consumer Sentiment Index rates the relative level of current and future economic conditions. There are two versions of this data released two weeks apart, preliminary and revised. The preliminary data tends to have a greater impact. The reading is compiled from a survey of around 500 consumers.

The Russell 1000 Index is a stock market index that tracks the highest-ranking 1,000 stocks in the Russell 3000 Index, which represent about 93% of the total market capitalization of that index.

The Russell 2000 Index is a small-cap stock market index that represents the bottom 2,000 stocks in the Russell 3000.

The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

Russell 1000 Growth Index tracks companies with higher price-to-book ratios, higher sales per share growth, and higher I/B/E/S forecast growth.

Russell 1000 Value Index tracks companies with lower price-to-book ratios and lower expected and historical growth rates. Russell’s value indexes focus more on dividend yield.

Nonfarm payrolls (NFPs) are the measure of the number of workers in the United States excluding farm workers and workers in a handful of other job classifications.

A municipal bond, commonly known as a muni, is a bond issued by state or local governments, or entities they create such as authorities and special districts.

The CBOE Volatility Index (VIX) is a real-time index that measures the expected volatility of the S&P 500 over the next

30 days.

The U.S. Treasury index is based on the recent auctions of U.S. Treasury bills. Occasionally it is based on the U.S. Treasury’s daily yield curve.

The 30 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 30 years.

The Bloomberg Barclays U.S. Corporate High-Yield Index covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

The Bloomberg Barclays U.S. Credit Index measures the investment grade, U.S. dollar denominated, fixed-rate taxable corporate and government related bond markets.

The Bloomberg Aggregate Bond Index or “the Agg” is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance.

The Bloomberg US Trsy Bellwether 30Y is a U.S. Treasury debt obligation that has a maturity of 30 years.

The ISM Non-Manufacturing Index is an index based on surveys of more than 400 non-manufacturing firms’ purchasing and supply executives, within 60 sectors across the nation, by the Institute of Supply Management (ISM). The ISM Non-Manufacturing Index tracks economic data, like the ISM Non-Manufacturing Business Activity Index. A composite diffusion index is created based on the data from these surveys, that monitors economic conditions of the nation.

ISM Manufacturing Index measures manufacturing activity based on a monthly survey, conducted by Institute for Supply Management (ISM), of purchasing managers at more than 300 manufacturing firms.

The MSCI Emerging Markets Index captures large and mid cap representation across 27 Emerging Markets (EM) countries.

The MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 Developed Markets (DM) countries (excluding the US) and 27 Emerging Markets (EM) countries*. With 2,359 constituents, the index covers approximately 85% of the global equity opportunity set outside the US.

The S&P CoreLogic Case-Shiller 20-City Composite Home Price NSA Index seeks to measures the value of residential real estate in 20 major U.S. metropolitan areas. The U.S. Treasury index is based on the recent auctions of U.S. Treasury bills. Occasionally it is based on the U.S. Treasury’s daily yield curve.

The Leading Economic Index provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term.

In the United States, the Core Personal Consumption Expenditure Price (CPE) Index provides a measure of the prices paid by people for domestic purchases of goods and services, excluding the prices of food and energy.

The Conference Board’s Leading Indexes are the key elements in an analytic system designed to signal peaks and troughs in the business cycle. The leading, coincident, and lagging economic indexes are essentially composite averages of several individual leading, coincident, or lagging indicators. They are constructed to summarize and reveal common turning point patterns in economic data in a clearer and more convincing manner than any individual component – primarily because they smooth out some of the volatility of individual components.

Gross domestic product (GDP) is the standard measure of the value added created through the production of goods and services in a country during a certain period.