As expected, the Federal Reserve cut the overnight lending rate by 0.25% yesterday. The Fed Funds rate has moved lower, from a range of 5.25%-5.50% to 4.25%-4.50%, a full percentage point lower since the Fed’s rate-cutting cycle started in September. This cut marks the equivalent of the Fed’s fourth 25 basis point cut this year, exactly matching our expectations laid out in January. Coming into the year, in our annual Market Outlook we said, “The market is pricing in six cuts in 2024. That is likely too aggressive; we see four cuts.”

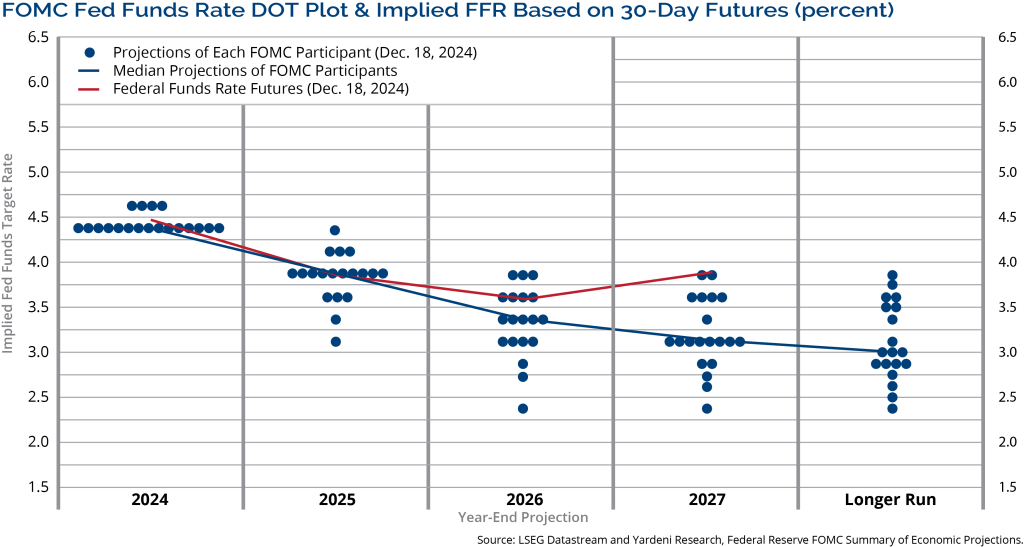

It turned out to be a hawkish cut as the Fed indicated that the pace of rate cuts is set to slow next year. The Fed signaled that they are likely to cut rates only twice next year, not four as had previously been priced into the markets as recently as October, as the inflation downtrend has stalled, and the economy is proving to be more resilient than the FOMC expected.

The Fed’s DOTS plot showed two cuts expected for 2025 and a long run rate of 3.0% in the Fed Funds rate, which is higher than previous plots.

For illustrative purposes. Past performance is not indicative of future results. Neither past actual, projections, nor other forward looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

The Fed’s Statement of Economic Projections (SEP) showed more concern about inflation. FOMC participants raised their core Persconal Consumption Expenditures (PCE) inflation forecast by 0.3% for 2025, from 2.2% to 2.5%, suggesting that they are expecting higher inflation next year and are less certain about hitting their 2.0% target. GDP for next year was revised up to 2.1% from 2.0% in September and the unemployment rate was revised down to 4.3% from 4.4%. Participants were more uncertain about their inflation projections and slightly more uncertain about their GDP projections.

In the press conference, Fed Chairman Powell said, “We need to see progress on inflation… That is how we are thinking about it. It is kind of a new thing. We moved quickly to get to here but moving forward we are moving slower.”

The market certainly didn’t like the hawkish cut nor Fed Chair Powell’s comments. The markets immediately sold off and rates surged higher. It was the worst loss for the S&P 500 on a Fed rate decision day since 2001.

Let’s see how the market responds from here. From our perspective, there wasn’t much new news in the Fed’s actions. We have maintained that the economy has been remarkably resilient and that our base case assumption was for the economy to avoid a recession. Our belief is that inflation is on a gradual (though not linear) path to 2% and the strength of the labor market will help the economy avoid a recession. Our outlook is consistent with the Fed’s updated projections. A silver lining for the market is that the selloff resulted in the market reaching an oversold condition, given the extreme selling pressure yesterday, and the second half of December is normally a seasonally strong period.

From a big picture standpoint, operating earnings are hitting new highs and the Fed is now a tailwind (though milder than previously expected) for the market. These are favorable conditions for stocks and bonds. We believe the secular bull market remains intact and that pullbacks and corrections are normal and expected on that path higher.

Information and opinions expressed are those of the author(s) and do not reflect the opinions of other investment teams within Clark Capital, unless otherwise expressly noted. The information referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. There is no guarantee of the future performance of any Clark Capital investment portfolio. Material presented has been derived from sources considered to be reliable, but the accuracy and completeness cannot be guaranteed. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any sectors or securities, other investments or to adopt any investment strategy or strategies. For educational use only. This information is not intended to serve as investment advice. This material is not intended to be relied upon as a forecast or research. The investment or strategy discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Past performance does not guarantee future results.

This document may contain certain information that constitutes forward-looking statements which can be identified by the use of forward-looking terminology such as “may”, “expect,” “will,” “hope,” “forecast”, “intend”, “target,” “believe,” and/or comparable terminology (or the negative thereof). No assurance, representation, or warranty is made by any person that any of Clark Capital’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future.

Investing involves risk, including loss of principal.

Clark Capital Management Group, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Clark Capital’s advisory services can be found in its Form ADV which is available upon request.

This is not a recommendation to buy or sell a particular security. Please see attached disclosures.

The S&P 500 measures the performance of the 500 leading companies in leading industries of the U.S. economy, capturing 80% of U.S. equities.

A statement of economic projections, also known as a Summary of Economic Projections (SEP), is a collection of forecasts for the future of the economy.

PCE inflation is a measure of inflation in the United States economy that tracks how much consumers pay for goods and services

Gross domestic product (GDP) is the total value of all goods and services produced in a country, minus the value of the goods and services used to make them.