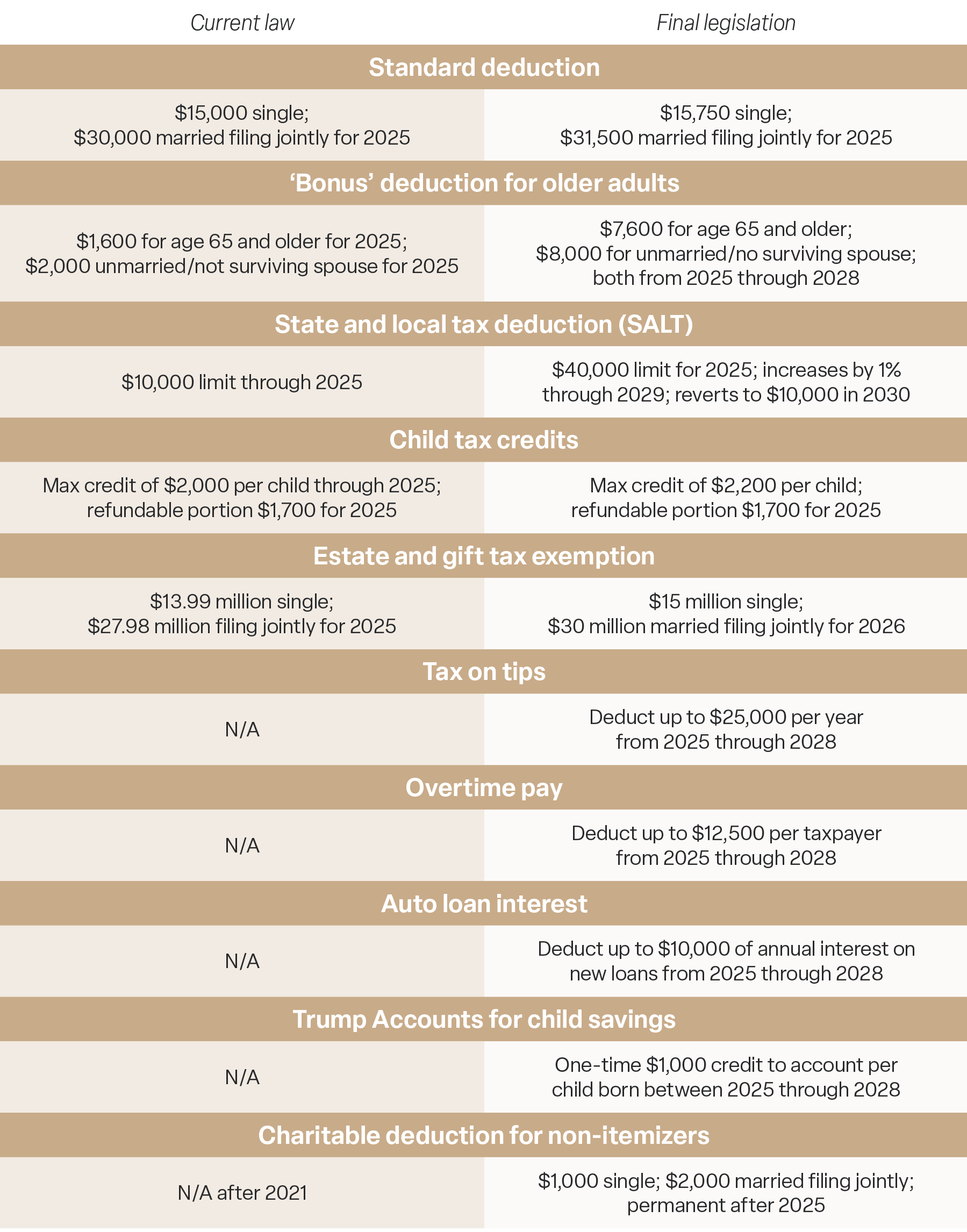

On July 4, President Trump signed into law the One Big Beautiful Bill Act. The most notable aspects of the new legislation include the continuation of the lower corporate and individual tax rates established under the Tax Cuts and Jobs Act passed during President Trump’s first term. The estate tax and gift tax exemptions will be increased to $15 million for individuals and $30 million for couples. Overall, the tax and spending aspects of the Act should be stimulative for the economy but will likely lead to larger budget deficits and increased government indebtedness. The table below summarizes some notable aspects of the Act on individual taxpayers.

Key individual tax changes from Trump’s ‘big beautiful’ bill

Current law vs. final legislation

https://www.cnbc.com/amp/2025/07/03/trump-big-beautiful-bill-tax-changes.html

Impact on Businesses

In addition to the impact on individuals, the new legislation contains several provisions that will impact businesses. Of note are provisions that would give businesses tax incentives for research and development and for investment in property, plant, and equipment. Below are some of the tax provisions impacting businesses.

Business Tax Provisions

- Permanently restore immediate expensing for domestic research and development (R&D) expenses; small businesses with gross receipts of $31 million or less can retroactively expense R&D back to after 12/31/21; all other domestic R&D between 12/21/21 and 1/1/25 can accelerate remaining deductions over a one- or two-year period.

- Permanently reinstate the EBITDA-based limitation on business net interest deductions.

- Permanently restore 100 percent bonus depreciation for short-lived investments.

- Temporarily provide 100 percent expensing of qualifying structures, with the beginning of construction occurring after Jan. 19, 2025, and before Jan. 19, 2029, and placed in service before Jan. 1, 2031.

- Make the Section 199A pass-through deduction permanent; increase phase-in range of limitation by $50,000 for non-joint returns and $100,000 for joint returns; create a minimum deduction of $400 for taxpayers with $1,000 or more of qualified business income (QBI) for material participants.

- Implement a one percent floor on deduction of charitable contributions made by corporations.

- Eliminate clean electricity production credit (45Y) and investment credit (48E) for projects placed in service after 2027, except for baseload power sources such as nuclear, hydropower, geothermal, and battery storage; introduce restrictions related to foreign entities of concern (FEOC) and add excise tax for wind and solar projects related to FEOC content thresholds.

- Repeal clean hydrogen production credit (45V) after 2027 and the deduction for energy-efficient commercial buildings (179D) after one year of law’s enactment.

- Extend the clean fuel production credit (45Z) until 2030 and expand eligibility.

- Introduce FEOC restrictions for several other credits, including the nuclear production credit (45U), the clean fuel production credit (45Z), the carbon oxide sequestration credit (45Q), and the advanced manufacturing production credit (45X); alter phaseouts and eligibility for 45X and 45Q.

- Require intangible drilling and development costs to be taken into account for the purposes of computing adjusted financial statement income.

- Add income from hydrogen storage, carbon capture, advanced nuclear, hydropower, and geothermal energy to qualifying income of certain publicly traded partnerships treated as C corporations.

Impact on the Economy and the Markets

From an economic perspective, the likelihood of a recession has diminished even further and corporate earnings should get a boost. The Tax Foundation estimates that long-term GDP growth would be boosted by about 1.2% and the budget deficit would increase by $3.8 trillion from 2025 through 2034.

From a market perspective, the legislation is favorable for stocks but less favorable for bonds as interest rates could increase somewhat in reaction to the larger federal debt levels required to finance the deficit. The S&P 500, Nasdaq Composite, Bloomberg Corporate High Yield Index, the ICE CCC High Yield Index, and the NYSE Cumulative Advance-Decline Line are all trading at new all-time highs. This illustrates the strength and breadth of the recent rally. In addition, the S&P 500 Index’s 50-day moving average rose above its 200-day moving average, in what is normally referred to as a “golden cross.” Ed Yardeni commented on this saying that “golden crosses” tend to be bullish breakout patterns, indicating the possibility of a long-term bull market.

After the big rally to new highs, sentiment is no longer the tailwind it provided just following the April lows. The caveat here is that sentiment works better at bottoms than tops, and it’s best to wait for the sentiment turn. The American Association of Individual Investors (AAII) sentiment poll now shows more bulls than bears. In the latest poll, 45% of investors polled are bullish, up from 20% at the lows. Meanwhile, 33.1% of investors are bearish, down from 61.9%.

On the tariff front, the administration has postponed implementation of the higher reciprocal tariffs deadline on July 9. While the situation is quite fluid, it has been announced that many countries will receive “take it or leave it” letters from the U.S. stating what the new tariff rates will be. It is believed at this time that those higher rates would take effect on August 1. Negotiations continue with our largest trading partners, and more deals could potentially be announced in the coming days. Treasury Secretary Scott Bessent said in an interview on CNN’s “State of the Union” that a country’s tariffs will go back to April 2 levels on August 1 if there is no progress on signing a deal with the U.S. Bessent also said, “I would expect to see several big announcements over the next couple of days.”

Bottom Line for Advisors

With the passage of the new tax and spending bill, clients are likely to benefit from extended tax relief and a more favorable economic backdrop—particularly business owners and high-net-worth individuals affected by the increased exemption limits. However, the unresolved tariff situation could introduce market volatility in the near term. Now is a good time to proactively connect with clients to discuss planning opportunities, assess portfolio positioning considering the evolving policy landscape, and to help them stay focused on long-term goals amid shifting headlines.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. There is no guarantee of the future performance of any Clark Capital investments portfolio. Material presented has been derived from sources considered to be reliable and has not been independently verified by us or our personnel. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, other investments or to adopt any investment strategy or strategies. For educational use only. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Past performance does not guarantee future results.

References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time (each, an “index”) are provided for your information only. Reference to an index does not imply that the portfolio will achieve returns, volatility or other results similar to that index. The composition of the index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Investors cannot invest directly in an index.

The Standard and Poor’s 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. The S&P 500 EWI is maintained in accordance with the index methodology of the S&P 500, which measures 500 leading companies in leading U.S. industries. The S&P 500 EWI measures the performance of the same 500 companies, in equal weights. As such, sector exposures in the S&P 500 EWI will differ.

The Bloomberg U.S. Corporate High Yield Bond Index is a benchmark that measures the performance of USD-denominated, high-yield, fixed-rate corporate bonds issued in the U.S. These bonds are typically rated below investment grade, meaning they are considered riskier and offer higher yields to compensate for that risk.

The ICE BofA CCC & Lower US High Yield Index tracks the performance of USD-denominated, non-investment grade corporate bonds rated CCC or lower by major credit rating agencies. These bonds are publicly issued in the US domestic market and must have at least one year of remaining maturity and a fixed coupon schedule.

The NYSE Cumulative Advance-Decline (A/D) Line is a technical indicator that tracks the cumulative difference between the number of stocks on the New York Stock Exchange (NYSE) that have advanced and declined on a daily basis. It’s a measure of market breadth, showing how many stocks are participating in a market’s overall movement.

This document may contain certain information that constitutes forward-looking statements which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/ or comparable terminology (or the negative thereof). Forward looking statements cannot be guaranteed.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

Clark Capital Management Group, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Clark Capital’s advisory services and fees can be found in its Form ADV and/or Form CRS, which are available upon request.