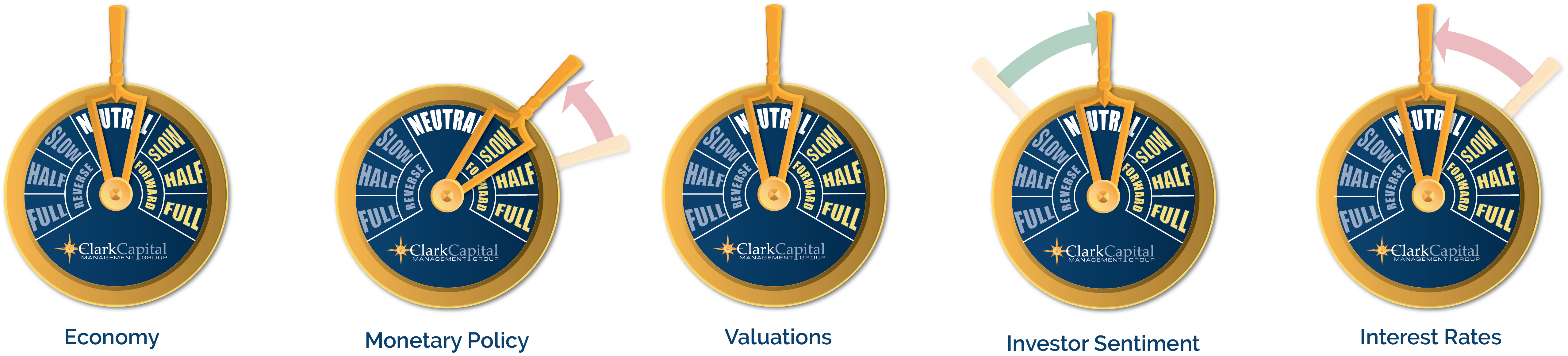

Clark Capital’s Economic Gauges

Clark Capital’s Bottom-Up, Fundamental Strategies

Albeit a small gain in mostly interest rate agnostic U.S. large-cap growth stocks, stocks broadly declined in December as the U.S. Central Bank gave investors a “hawkish cut” of 0.25% in the fed funds rate to 4.50%. Since September, the expected terminal 2025 fed funds rate has risen nearly 1% to 3.90%, as Core PCE sits at 2.8%, 0.2% above its cycle low reached in June. 10-year U.S. Treasury yields have similarly risen as sticky inflation has corroborated with potentially accelerating U.S. economic growth.

Since September 18th, the fed funds rate decreased by 100 basis points versus a 100 basis-point rise in the 10-year Treasury Note yield. Higher Treasury yields and expensive market multiples leave little room for error in achieving the estimated double-digit S&P 500 Index earnings growth in 2025. Ideally, earnings growth would account for most of the gain in 2025, with a slight decline in the forward P/E. If the earnings growth fails to meet expectations, a rotation into defensives could benefit dividend stocks.

As strong long-term returns are typically derived from low valuation starting points and vice versa, we will continue to seek out undervalued, antifragile companies with improving business momentum while maintaining a core position in what we believe the highest quality, structurally superior companies until their business models are materially threatened.

Below are strategy updates from December:

All Cap Core U.S. Equity

- The portfolio is fully invested with approximately ~76% in large-cap stocks and the remainder in mid- and small-cap companies and cash.

- During the month, to benefit from improving business fundamentals, the two most recent additions to the portfolio were a cloud networking solutions provider and a multinational telecommunications company. The most recent exit was a digital media software company.

High Dividend Equity

- The portfolio is positioned with 91% large-cap exposure, 7% mid-caps, and the remainder in cash. Financials represent the largest sector weight at 26.4% and above the benchmark weight.

- The next three largest portfolio weights are Industrials, Healthcare, and Information Technology at 14.8%, 10.9% and 9.3%, respectively.

- The top individual contributors to absolute portfolio return were a global communications technology company, a technology conglomerate, and a retail sporting goods company, versus underperformers, a residential homebuilder, an electrical equipment provider, and a multinational energy company.

International Equity ADR

- Navigator® International Equity/ADR is positioned with ~16% in emerging markets with the balance in developed economies and cash.

- Britain, Canada, China, Ireland, Japan, and Switzerland are the strategy’s largest country weights, all ranging between 8% and 22%.

- ADR’s exposure to China is now ~8.8% which is slightly above its weighting in the All-Country World ex US benchmark.

- Consumer Discretionary, Financials, Industrials, and Information Technology are our largest sector weights. During the month, the most recent exit from the portfolio was a multinational utilities company.

Taxable Fixed Income

- As the interest rate curve continued to steepen, the portfolio began to lighten up on shorter bonds (roughly 0.75-1.5 yr maturity). With the curve more normalized, these trades were able to increase yield in the portfolio for the first time in two years and added a marginal amount of duration.

- For example, we executed this strategy in the Technology sector in global payments bonds. We sold shorter duration bonds and bought slightly longer bonds, picking up an additional 21bps of yield and reducing the overall price on the bond as well. At the beginning of the year, these bonds traded at roughly the same yields.

- Looking ahead to 2025, the focus will be on adding yield in trades like the above, through either maturing bonds being reinvested in the 5-7 year portion of the curve or selling 1-2 year bonds and buying 5-7 years as the interest rate curve is expected to continue its normalization.

- We believe this should set the portfolio up to be able to maximize yield while also positioning it to maximize overall total return throughout the year.

Tax-Free Fixed Income

- Last month, we sold some of our 15- and 20-year bonds when the market was flattening in November, which helped us avoid losses when rates went up in December.

- Supply is expected to be ample in 1Q2025, so we will judiciously proceed ahead as opportunities allow, and will also look for opportunistic investments in the secondary market should volatility flare up.

- Fund and ETF inflows slowed at the end of the year, which might reduce the market crowding seen in new bond issues.

Clark Capital’s Top-Down, Quantitative Strategies

A year of strong equity market returns ended with a whimper as December seasonal strength failed to materialize into year end. For the month of December, the S&P 500 declined 2.39%, the Russell 2000 Index of small cap stocks dropped 8.26%, large cap growth inched higher by 0.88% and large cap value declined 6.85%. For the year, the indices posted solid gains. The S&P 500 gained 25.0%, the Russell 2000 gained 11.53%, and the Russell 1000 Growth and Value indices gained 33.35% and 14.35% respectively. It was only the 10th time in the post-WWII era that the S&P 500 posted back-to-back 20% plus total return years.

The Fed cut rates on December 18th in what turned out to be a hawkish cut, as Chairman Powell indicated that the pace of rate cuts is set to slow in 2025. The market certainly didn’t like the hawkish cut nor Fed Chair Powell’s comments. The markets immediately sold off and rates surged higher. The 10-year U.S. Treasury Yield ended the year at 4.57%, up nearly 100 bps from its mid-September low.

As we head into the New Year, the market is oversold and credit has remained firm, even during the recent selloff in risk assets. Our credit-based risk management models have remained fully risk-on now for over a year.

Below are strategy updates from December:

Alternative

- Within the mutual fund core, options-based, equity long-short, and multi-strategy have performed well, while commodity long-short and event-driven have lagged.

- The portfolio has added modestly to precious metals and commodity equities, while favoring loans and riskier credit in fixed income.

- We maintain a 12% cash buffer that we are looking to employ upon an overdue correction that we believe should come in the first half of 2025.

Fixed Income Total Return (MultiStrategy Fixed Income)

- Interest rates have spiked since mid-September, and the 100-basis-point move in the 10-year U.S. Treasury yield from 3.62% in September to 4.62% near year-end surprised nearly everyone.

- Markets have moved from pricing in over five cuts next year to just under two. Nevertheless, credit has been very solid, only recently showing even modest cracks.

- High yield maintains its record of performing well during times of rising rates.

Global Risk Management

- The portfolio continues to favor risk assets and stocks in particular, as our credit-driven models have been positive on equities since early November 2023.

- Tame credit spreads that recently approached all-time lows indicate a solid fundamental environment for equities.

- Until we see notable weakness, we anticipate continuing to overweight stocks and are now overweighting U.S. equities vs. international equities.

Global Tactical

- Credit conditions have served as a strong proxy for risk assets, and the decline of credit spreads has been correlated with equity market strength.

- The market weakness we saw in December has only been met by very modest credit weakness, and that looks to be a good sign for risk assets going forward.

- A recent breakout high by the U.S. Dollar drove us to increase the weighting of U.S. vs international equities.

Sector Opportunity

- The three largest cyclical growth sectors (Consumer Discretionary, Technology, and Telecommunication Services) make up the majority of the portfolio, along with broad financials and broker-dealers.

- The portfolio is allocated 41% to Technology, highlighted by cloud services and internet positions. Defensive Healthcare, Staples, and Utilities are to be avoided.

Style Opportunity (MultiStrategy Equity)

- Our models favor large-cap growth, which is perhaps the only way to overweight mega-cap tech leaders that have driven markets higher in Q4.

- While market leadership has been driven by giant tech companies, cyclicals outperforming defensives has proven to be an equally strong trend. Defensive ETFs and minimum volatility, as well as deep value stocks rank at the bottom of our matrix.

U.S. Strategic Beta

- The portfolio is roughly neutral with regard to value vs. growth, but it does maintain a position in low volatility U.S. stocks, and we will maintain that position until an overdue correction for equity markets. During that correction we would anticipate growth stock weakness.

- In 2025, we believe small-cap earnings expectations will improve, and small- and mid-caps could receive increased weight if this improvement materializes.

The views expressed are those of the author(s) and do not necessarily reflect the views of Clark Capital Management Group. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. There is no guarantee of the future performance of any Clark Capital investments portfolio. Material presented has been derived from sources considered to be reliable, but the accuracy and completeness cannot be guaranteed. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, other investments or to adopt any investment strategy or strategies. For educational use only. This information is not intended to serve as investment advice. This material is not intended to be relied upon as a forecast or research. The investment or strategy discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Past performance does not guarantee future results.

Fixed income securities are subject to certain risks including, but not limited to: interest rate (changes in interest rates may cause a decline in market value of an investment), credit, payment, call (some bonds allow the issuer to call a bond for redemption before it matures), and extension (principal repayments may not occur as quickly as anticipated, causing the expected maturity of a security to increase).

Foreign securities are more volatile, harder to price and less liquid than U.S. securities. They are subject to different accounting and regulatory standards and political and economic risks. These risks are enhanced in emerging market countries.

The “Economic Gauges” represent the firm’s expectations for the market, and how changes in the market will affect the strategy, but are only projections which assume certain economic conditions and industry developments and are subject to change without notice. For educational use only.

The S&P 500 measures the performance of the 500 leading companies in leading industries of the U.S. economy, capturing 75% of U.S. equities.

A 10-year Treasury note is a debt obligation issued by the U.S. Treasury Department that has a maturity of 10 years.

The CBOE Volatility Index (VIX) is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 Index (SPX).

The Bloomberg 5-Year Municipal Bond Index provides a broad-based performance measure of the U.S. municipal bond market, consisting of securities with 4-6 year maturities.

The Bloomberg Barclays U.S. Corporate High-Yield Index covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. Securitiesare classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Treasury yield is the return on investment, expressed as a percentage, on the U.S. government’s debt obligations. Looked at another way, the Treasury yield is the effective interest rate that the U.S. government pays to borrow money for different lengths of time.

The MSCI All Country World Index (ACWI) ex US is a market capitalization weighted index designed to provide a broad measure of equity-market performance throughout the world. The MSCI ACWI is maintained by Morgan Stanley Capital International (MSCI) and is comprised of stocks from 22 of 23 developed countries and 24 emerging markets.

AAA bonds are bonds that have the highest credit rating possible, indicating that they are considered a safe investment with the lowest risk of default.

The chartered financial analyst (CFA) charter is a globally-recognized professional designation offered by the CFA Institute, an organization that measures and certifies the competence and integrity of financial analysts.

Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

The securities of mid-cap companies may be subject to more abrupt or erratic market movements and may have lower trading volumes.

This document may contain certain information that constitutes forward-looking statements which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology (or the negative thereof). Forward looking statements cannot be guaranteed. No assurance, representation, or warranty is made by any person that any of Clark Capital’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future.

Clark Capital Management Group, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Clark Capital’s advisory services and fees can be found in its Form ADV which is available upon request. CCM-1188