Tensions in the Middle East have escalated further, with Israel and Iran exchanging missile and aerial attacks. Over the weekend, the U.S. became directly involved, targeting Iran’s nuclear facilities.

On Saturday night, U.S. forces attacked three of Iran’s nuclear sites, hitting Fordow, Natanz, and Isfahan. In a short speech on Saturday night after the attacks, President Trump said that Iran’s key nuclear sites were “completely and totally obliterated” by the strikes. He noted that many more sites in Iran could easily be destroyed if the Iranians retaliate.

Many questions remain about what happens next, and they are largely dependent on Iran’s response. Could dismantling Iran’s nuclear ambitions force negotiations? Possibly. It is also possible that Iran could retaliate in several ways, including increased attacks on Israel, attacks on U.S. military bases, terrorist attacks, or efforts to obstruct or shut down the Strait of Hormuz. Additionally, the reaction of the international community (particularly China and Russia) will be important in determining how this situation unfolds. We suspect the coming days will be telling.

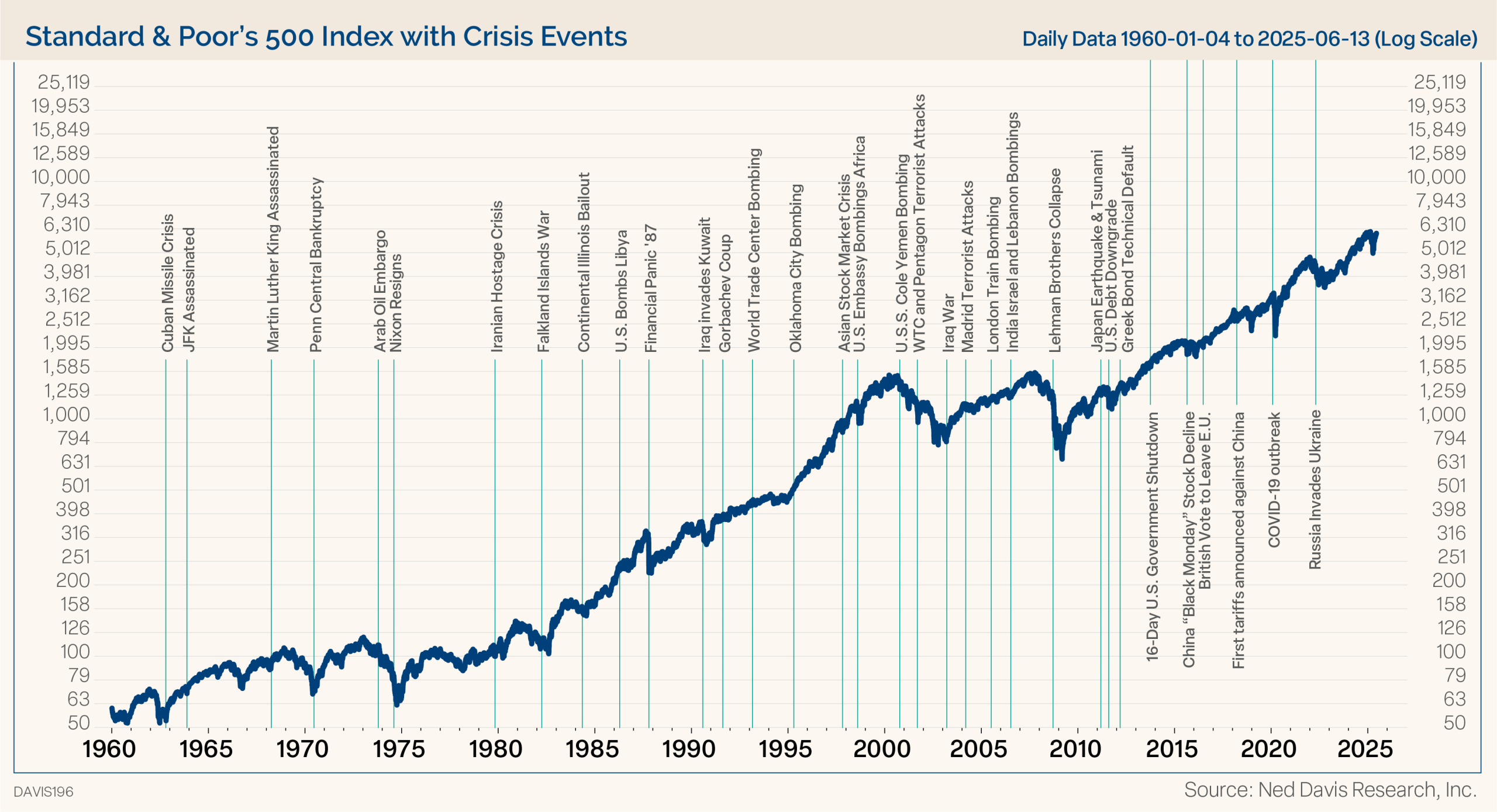

While every geopolitical event is different and scary, there are patterns and commonalities in how markets tend to react. Intuitively, you might think that geopolitical events would impact the market. It’s true that in general, investors tend to sell risk assets first and ask questions later. But over time, the market cares more about earnings and less about everything else.

That’s evident in the chart below, which shows how the S&P 500 has reacted to geopolitical events. After initial reactions to geopolitical events, the market usually rallies. The median initial response is a 3% decline, then the market recovers. One month later it’s 4.7% higher, three months later it’s 6.1% higher, six months later it’s 9.2% higher, and one year later it’s 16.9% higher on average.

The bottom line is this: the world is a scary place. It always has been and always will be. Do not let that fear come between you and your financial plan. Your financial plan was built with the understanding that markets are volatile and that geopolitical events exacerbate volatility. It is critical to stay focused on the long term and not to let short-term market volatility lead you to make emotionally driven decisions that could be detrimental to achieving your goals.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. There is no guarantee of the future performance of any Clark Capital investments portfolio. Material presented has been derived from sources considered to be reliable and has not been independently verified by us or our personnel. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, other investments or to adopt any investment strategy or strategies. For educational use only. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Past performance does not guarantee future results.

References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time (each, an “index”) are provided for your information only. Reference to an index does not imply that the portfolio will achieve returns, volatility or other results similar to that index. The composition of the index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Investors cannot invest directly in an index.

The Standard and Poor’s 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. The S&P 500 EWI is maintained in accordance with the index methodology of the S&P 500, which measures 500 leading companies in leading U.S. industries. The S&P 500 EWI measures the performance of the same 500 companies, in equal weights. As such, sector exposures in the S&P 500 EWI will differ.

This document may contain certain information that constitutes forward-looking statements which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/ or comparable terminology (or the negative thereof). Forward looking statements cannot be guaranteed.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

Clark Capital Management Group, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Clark Capital’s advisory services and fees can be found in its Form ADV and/or Form CRS, which are available upon request.