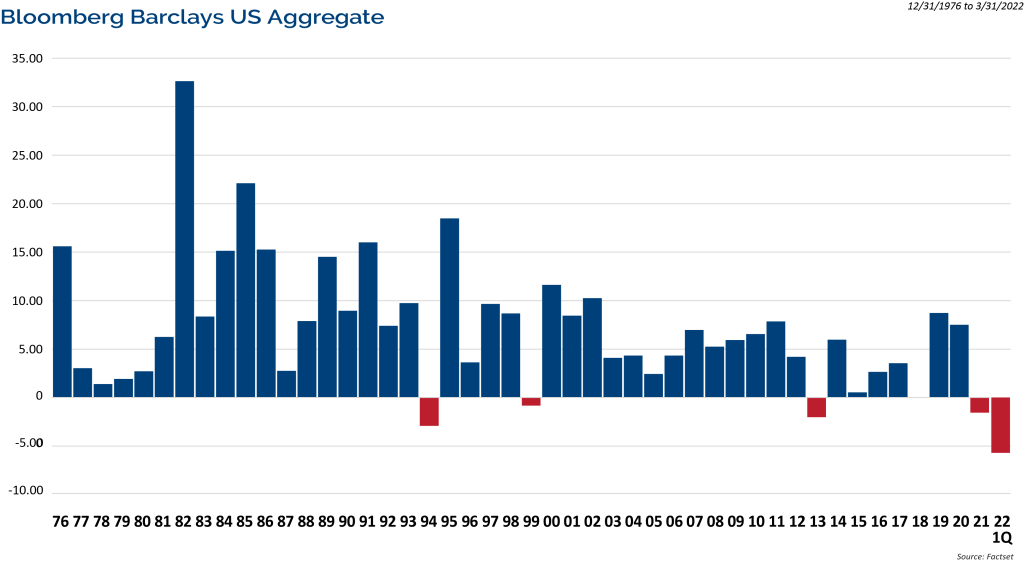

Bonds are boring. They are supposed to be. But every once in a while, bond prices go down. Usually, this occurs when interest rates have moved up. 2021 was one of those years and 2022 has started off that way as well. Last year, the 10-year Treasury went from a yield of 0.93% to 1.52%, creating losses for U.S. Treasuries and smaller losses for investment grade bonds. As a result, the Bloomberg Barclays U.S. Aggregate Bond Index declined by 1.5% in 2021. This was only the 4th negative calendar year for this index since its inception in 1976. High yield bonds, which have the unusual characteristic of performing better in years when interest rates increase, enjoyed a positive return of 5.3% in 2021.

Why Should an Investor Want to Own Bonds?

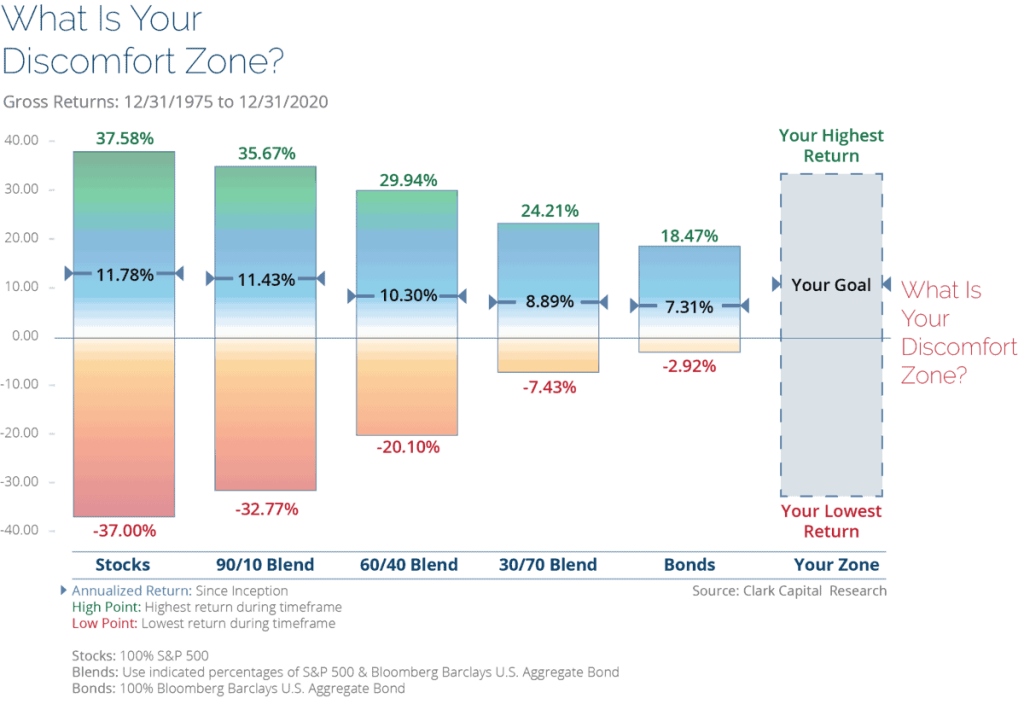

Stocks have historically been the best-performing asset class over time. Given that, if the only objective was total return, an investor would want a 100% equity portfolio. But the reality is that most investors shouldn’t want that, and in fact, they are often emotionally ill-equipped to handle the volatility associated with an all equity portfolio. When stocks prices decline, skittish investors will panic and cash out of their stock portfolios. We have seen this play out many times before. According to the Dalbar study, the S&P 500 Index earned 5.6%, while the average equity investor only earned 3.88% over a 20-year period[1].

That leads us to the answer to the question posed why should an investor want to own bonds? Quite simply, an investor should have enough bonds in their overall portfolio so that they can sleep at night. As the chart above shows, a bad year in bonds looks nothing like a bad year in stocks. Remember 2008? The S&P 500 declined by a whopping 38% before dividends. The worst year ever for the Bloomberg Barclays U.S. Aggregate Bond Index was 1994; it was down -2.92%. That year, the Federal Reserve raised the Fed Funds rate 6 times, taking it from 3% to 5.5% by the end of the year. The 10-year Treasury went from 5.8% to 7.8% in 1994. That is Armageddon for the bond world, and the index was only down -2.92%.

We believe investors should turn to bonds to provide stable cash flow and to offset the volatility of stocks. Bonds can be viewed as an investor’s safety net, and for good reason. The graph below shows that bonds can meaningfully reduce the volatility of a client’s portfolio. In plain English, the market value of a portfolio that includes bonds will not move up and down with the same magnitude as an all-stock portfolio.

Take Comfort, You Own the Individual Bonds

That doesn’t mean there haven’t been periods of time when bonds have struggled. There certainly have been. The beauty of owning individual bonds is that if they are held to maturity and the issuer doesn’t default, one can determine the cashflow each bond will generate to the penny and sleep better at night knowing that return will be positive. Each bond is a contractual obligation from the issuer to pay the holder of the bond, interest (usually twice per year), and the par value of that bond back to the holder at maturity. That should be comforting.

Why Would Clark Capital Ever Sell a Bond?

The short answer is, to buy a better bond. We believe a better bond will usually have some or all of the following characteristics: a better credit profile, higher income, better duration (sensitivity to interest rate changes), or better positioning on the yield curve. Sometimes, we will realize a small loss in the bond we sold to buy the more attractive bond.

That might seem odd, but keep in mind that the more attractive bond was likely not available to buy when we bought the original bond. Bonds are only available when someone is selling them, which is vastly different than how the stock market works. This gets to the very essence of active management. The goal of active management is to add incremental returns over a buy-and-hold (laddered bond) portfolio.

Always Think Long-Term

We believe an actively managed portfolio of individual bonds may offer important benefits during temporary pullbacks in the marketplace. Our experienced team of portfolio managers seeks to buy what we believe are attractively priced bonds that have desirable attributes, such as a higher yield or a better credit profile.

As always, we believe the best way for investors to achieve their financial goals is by sticking to their long-term investment plan and not letting swings in the market steer them off course. While we expect stocks to outperform bonds this year (and in most years), we believe investors should be weary of abandoning the safety of bonds for the allure of stocks. Bonds will always have a place in a diversified portfolio, which is to provide cash flow and to offset the volatility of stocks. Nothing has changed in that regard.

[1] Source: Dalbar as of 12/31/2018. Past performance is not indicative of future results.

The opinions expressed are those of the author(s) or the Clark Capital Management Group portfolio manager(s) that manage the strategies or products discussed herein, and do not necessarily reflect the opinions of all portfolio managers at Clark Capital Management Group or the firm as a whole.

There is no guarantee of the future performance of any Clark Capital investment portfolio. Material presented has been derived from sources considered to be reliable, but the accuracy and completeness cannot be guaranteed. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, other investments or to adopt any investment strategy or strategies. For educational use only. This information is not intended to serve as investment advice. This material is not intended to be relied upon as a forecast or research. The investment or strategy discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Past performance does not guarantee future results.

The Bloomberg Barclays US Aggregate Bond Index, or the Agg, is a broad base, market capitalization weighted bond market index representing intermediate term investment grade bonds traded in the United States.

The Bloomberg Barclays U.S. Treasury Bond Index includes public obligations of the US Treasury, ie US government bonds.

The Bloomberg Barclays US Intermediate Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market.

The Bloomberg Barclays 5 Year Municipal Bond Index is a capitalization weighted bond index created by Bloomberg Barclays intended to be representative of major municipal bonds of all quality ratings with an average maturity of approximately five years.

The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance.

High yield bonds are bonds that pay higher interest rates because they have lower credit ratings than investment-grade bonds.

Fixed income securities are subject to certain risks including, but not limited to: interest rate (changes in interest rates may cause a decline in market value or an investment), credit, prepayment, call (some bonds allow the issuer to call a bond for redemption before it matures), and extension (principal repayments may not occur as quickly as anticipated, causing the expected maturity of a security to increase).

This document may contain certain information that constitutes forward-looking statements which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology (or the negative thereof). Forward looking statements cannot be guaranteed. No assurance, representation, or warranty is made by any person that any of Clark Capital’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. Clark Capital Management Group, Inc. reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Clark Capital Management Group, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Clark Capital’s advisory services and fees can be found in its Form ADV which is available upon request.